Latest

Are you looking forward to knowing how to deal with the AI-dominated world? Find some of the best AI assistants in the market that...

News

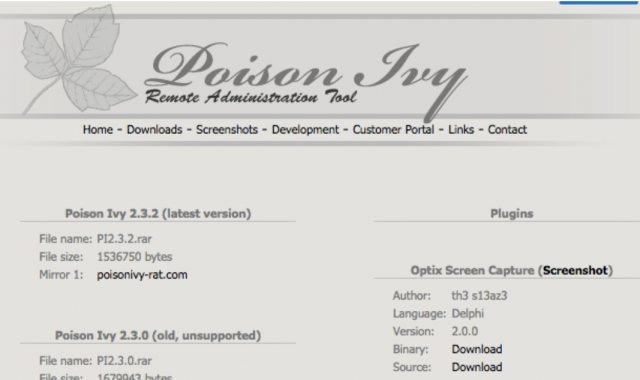

TROJAN RAT Stalking software lets stalkers monitor actions, create SMS, e-mail and other digital content seemingly authored by their victims, use the device to...

The BASA Awards, a platform designed exclusively to celebrate the best of small businesses, is proud to announce the launch of its YouTube channel,...

Fashion

(Isstories Editorial):- Nashville, Tennessee Apr 19, 2024 (Issuewire.com) - Get ready to experience the epitome of luxury athleisure wear as Feline Apparel, a premier brand in...

(Isstories Editorial):- Fort Lauderdale, Florida Apr 17, 2024 (Issuewire.com) - In a ground-breaking development bridging digital assets and cannabis culture, the iconic Mutant Ape Yacht Club...

Lifestyle

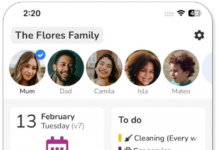

Cirkl – the all-in-one family app – is now being launched for parents in New Zealand, to simplify everyday life for families.(Isstories Editorial):- Auckland,...

Cheeky Butler Albufeira previews the start of the 2024 summer season for exclusive boat parties in the Portuguese Algarve, one of the most sought-after...

Entertainment

The BASA Awards, a platform designed exclusively to celebrate the best of small businesses, is proud to announce the launch of its YouTube channel,...

Cheeky Butler Albufeira previews the start of the 2024 summer season for exclusive boat parties in the Portuguese Algarve, one of the most sought-after...

Aries

Mar 21-Apr 20

Today's Horoscope

Sat, April 27th 2024: ...

AriesMar 21-Apr 20

AriesMar 21-Apr 20

Taurus

Apr 21-May 21

Today's Horoscope

Sat, April 27th 2024: ...

TaurusApr 21-May 21

TaurusApr 21-May 21

Gemini

May 22-Jun 21

Today's Horoscope

Sat, April 27th 2024: ...

GeminiMay 22-Jun 21

GeminiMay 22-Jun 21

Cancer

Jun 22-Jul 22

Today's Horoscope

Sat, April 27th 2024: ...

CancerJun 22-Jul 22

CancerJun 22-Jul 22

Leo

Jul 23-Aug 23

Today's Horoscope

Sat, April 27th 2024: ...

LeoJul 23-Aug 23

LeoJul 23-Aug 23

Virgo

Aug 24-Sep 22

Today's Horoscope

Sat, April 27th 2024: ...

VirgoAug 24-Sep 22

VirgoAug 24-Sep 22

Libra

Sep 23-Oct 23

Today's Horoscope

Sat, April 27th 2024: ...

LibraSep 23-Oct 23

LibraSep 23-Oct 23

Scorpio

Oct 24-Nov 22

Today's Horoscope

Sat, April 27th 2024: ...

ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22

Sagittarius

Nov 23-Dec 21

Today's Horoscope

Sat, April 27th 2024: ...

SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21

Capricorn

Dec 22-Jan 20

Today's Horoscope

Sat, April 27th 2024: ...

CapricornDec 22-Jan 20

CapricornDec 22-Jan 20

Aquarius

Jan 21-Feb 18

Today's Horoscope

Sat, April 27th 2024: ...

AquariusJan 21-Feb 18

AquariusJan 21-Feb 18

Pisces

Feb 19-Mar 20

Today's Horoscope

Sat, April 27th 2024: ...

PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20

Aries

Mar 21-Apr 20

Today's Horoscope

Sat, April 27th 2024: ...

AriesMar 21-Apr 20

AriesMar 21-Apr 20

Taurus

Apr 21-May 21

Today's Horoscope

Sat, April 27th 2024: ...

TaurusApr 21-May 21

TaurusApr 21-May 21

Gemini

May 22-Jun 21

Today's Horoscope

Sat, April 27th 2024: ...

GeminiMay 22-Jun 21

GeminiMay 22-Jun 21

Cancer

Jun 22-Jul 22

Today's Horoscope

Sat, April 27th 2024: ...

CancerJun 22-Jul 22

CancerJun 22-Jul 22

Leo

Jul 23-Aug 23

Today's Horoscope

Sat, April 27th 2024: ...

LeoJul 23-Aug 23

LeoJul 23-Aug 23

Virgo

Aug 24-Sep 22

Today's Horoscope

Sat, April 27th 2024: ...

VirgoAug 24-Sep 22

VirgoAug 24-Sep 22

Libra

Sep 23-Oct 23

Today's Horoscope

Sat, April 27th 2024: ...

LibraSep 23-Oct 23

LibraSep 23-Oct 23

Scorpio

Oct 24-Nov 22

Today's Horoscope

Sat, April 27th 2024: ...

ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22

Sagittarius

Nov 23-Dec 21

Today's Horoscope

Sat, April 27th 2024: ...

SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21

Capricorn

Dec 22-Jan 20

Today's Horoscope

Sat, April 27th 2024: ...

CapricornDec 22-Jan 20

CapricornDec 22-Jan 20

Aquarius

Jan 21-Feb 18

Today's Horoscope

Sat, April 27th 2024: ...

AquariusJan 21-Feb 18

AquariusJan 21-Feb 18

Pisces

Feb 19-Mar 20

Today's Horoscope

Sat, April 27th 2024: ...

PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20

AriesMar 21-Apr 20

AriesMar 21-Apr 20 TaurusApr 21-May 21

TaurusApr 21-May 21 GeminiMay 22-Jun 21

GeminiMay 22-Jun 21 CancerJun 22-Jul 22

CancerJun 22-Jul 22 LeoJul 23-Aug 23

LeoJul 23-Aug 23 VirgoAug 24-Sep 22

VirgoAug 24-Sep 22 LibraSep 23-Oct 23

LibraSep 23-Oct 23 ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22 SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21 CapricornDec 22-Jan 20

CapricornDec 22-Jan 20 AquariusJan 21-Feb 18

AquariusJan 21-Feb 18 PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20 AriesMar 21-Apr 20

AriesMar 21-Apr 20 TaurusApr 21-May 21

TaurusApr 21-May 21 GeminiMay 22-Jun 21

GeminiMay 22-Jun 21 CancerJun 22-Jul 22

CancerJun 22-Jul 22 LeoJul 23-Aug 23

LeoJul 23-Aug 23 VirgoAug 24-Sep 22

VirgoAug 24-Sep 22 LibraSep 23-Oct 23

LibraSep 23-Oct 23 ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22 SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21 CapricornDec 22-Jan 20

CapricornDec 22-Jan 20 AquariusJan 21-Feb 18

AquariusJan 21-Feb 18 PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20