Latest

Are you looking forward to knowing how to deal with the AI-dominated world? Find some of the best AI assistants in the market that...

News

Making Waves in the World of Holistic Health(Isstories Editorial):- New York City, New York Apr 26, 2024 (Issuewire.com) - A seasoned chiropractor and functional medicine practitioner,...

Exploring Dr. Daniel’s Multifaceted Career Path From Law Enforcement to Lifesaver(Isstories Editorial):- New York City, New York Apr 26, 2024 (Issuewire.com) - Dr. Daniel's impressive career...

Fashion

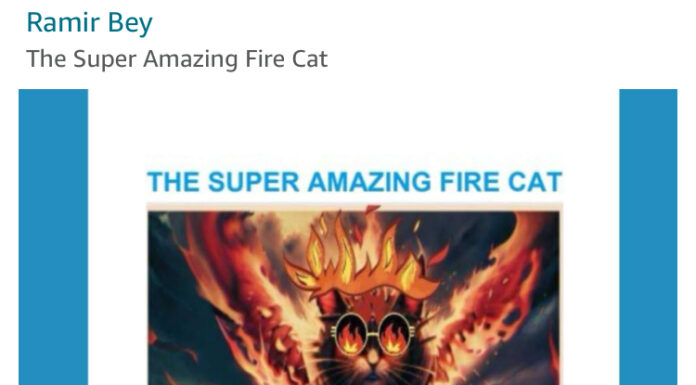

(Isstories Editorial):- Nashville, Tennessee Apr 19, 2024 (Issuewire.com) - Get ready to experience the epitome of luxury athleisure wear as Feline Apparel, a premier brand in...

(Isstories Editorial):- Fort Lauderdale, Florida Apr 17, 2024 (Issuewire.com) - In a ground-breaking development bridging digital assets and cannabis culture, the iconic Mutant Ape Yacht Club...

Lifestyle

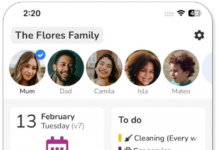

Cirkl – the all-in-one family app – is now being launched for parents in New Zealand, to simplify everyday life for families.(Isstories Editorial):- Auckland,...

Cheeky Butler Albufeira previews the start of the 2024 summer season for exclusive boat parties in the Portuguese Algarve, one of the most sought-after...

Entertainment

Cheeky Butler Albufeira previews the start of the 2024 summer season for exclusive boat parties in the Portuguese Algarve, one of the most sought-after...

(Isstories Editorial):- New York City, New York Apr 25, 2024 (Issuewire.com) - Conch Shell International Film Fest 2024 announces Imagine Products has joined its community of...

Aries

Mar 21-Apr 20

Today's Horoscope

Sat, April 27th 2024: ...

AriesMar 21-Apr 20

AriesMar 21-Apr 20

Taurus

Apr 21-May 21

Today's Horoscope

Sat, April 27th 2024: ...

TaurusApr 21-May 21

TaurusApr 21-May 21

Gemini

May 22-Jun 21

Today's Horoscope

Sat, April 27th 2024: ...

GeminiMay 22-Jun 21

GeminiMay 22-Jun 21

Cancer

Jun 22-Jul 22

Today's Horoscope

Sat, April 27th 2024: ...

CancerJun 22-Jul 22

CancerJun 22-Jul 22

Leo

Jul 23-Aug 23

Today's Horoscope

Sat, April 27th 2024: ...

LeoJul 23-Aug 23

LeoJul 23-Aug 23

Virgo

Aug 24-Sep 22

Today's Horoscope

Sat, April 27th 2024: ...

VirgoAug 24-Sep 22

VirgoAug 24-Sep 22

Libra

Sep 23-Oct 23

Today's Horoscope

Sat, April 27th 2024: ...

LibraSep 23-Oct 23

LibraSep 23-Oct 23

Scorpio

Oct 24-Nov 22

Today's Horoscope

Sat, April 27th 2024: ...

ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22

Sagittarius

Nov 23-Dec 21

Today's Horoscope

Sat, April 27th 2024: ...

SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21

Capricorn

Dec 22-Jan 20

Today's Horoscope

Sat, April 27th 2024: ...

CapricornDec 22-Jan 20

CapricornDec 22-Jan 20

Aquarius

Jan 21-Feb 18

Today's Horoscope

Sat, April 27th 2024: ...

AquariusJan 21-Feb 18

AquariusJan 21-Feb 18

Pisces

Feb 19-Mar 20

Today's Horoscope

Sat, April 27th 2024: ...

PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20

Aries

Mar 21-Apr 20

Today's Horoscope

Sat, April 27th 2024: ...

AriesMar 21-Apr 20

AriesMar 21-Apr 20

Taurus

Apr 21-May 21

Today's Horoscope

Sat, April 27th 2024: ...

TaurusApr 21-May 21

TaurusApr 21-May 21

Gemini

May 22-Jun 21

Today's Horoscope

Sat, April 27th 2024: ...

GeminiMay 22-Jun 21

GeminiMay 22-Jun 21

Cancer

Jun 22-Jul 22

Today's Horoscope

Sat, April 27th 2024: ...

CancerJun 22-Jul 22

CancerJun 22-Jul 22

Leo

Jul 23-Aug 23

Today's Horoscope

Sat, April 27th 2024: ...

LeoJul 23-Aug 23

LeoJul 23-Aug 23

Virgo

Aug 24-Sep 22

Today's Horoscope

Sat, April 27th 2024: ...

VirgoAug 24-Sep 22

VirgoAug 24-Sep 22

Libra

Sep 23-Oct 23

Today's Horoscope

Sat, April 27th 2024: ...

LibraSep 23-Oct 23

LibraSep 23-Oct 23

Scorpio

Oct 24-Nov 22

Today's Horoscope

Sat, April 27th 2024: ...

ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22

Sagittarius

Nov 23-Dec 21

Today's Horoscope

Sat, April 27th 2024: ...

SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21

Capricorn

Dec 22-Jan 20

Today's Horoscope

Sat, April 27th 2024: ...

CapricornDec 22-Jan 20

CapricornDec 22-Jan 20

Aquarius

Jan 21-Feb 18

Today's Horoscope

Sat, April 27th 2024: ...

AquariusJan 21-Feb 18

AquariusJan 21-Feb 18

Pisces

Feb 19-Mar 20

Today's Horoscope

Sat, April 27th 2024: ...

PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20

AriesMar 21-Apr 20

AriesMar 21-Apr 20 TaurusApr 21-May 21

TaurusApr 21-May 21 GeminiMay 22-Jun 21

GeminiMay 22-Jun 21 CancerJun 22-Jul 22

CancerJun 22-Jul 22 LeoJul 23-Aug 23

LeoJul 23-Aug 23 VirgoAug 24-Sep 22

VirgoAug 24-Sep 22 LibraSep 23-Oct 23

LibraSep 23-Oct 23 ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22 SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21 CapricornDec 22-Jan 20

CapricornDec 22-Jan 20 AquariusJan 21-Feb 18

AquariusJan 21-Feb 18 PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20 AriesMar 21-Apr 20

AriesMar 21-Apr 20 TaurusApr 21-May 21

TaurusApr 21-May 21 GeminiMay 22-Jun 21

GeminiMay 22-Jun 21 CancerJun 22-Jul 22

CancerJun 22-Jul 22 LeoJul 23-Aug 23

LeoJul 23-Aug 23 VirgoAug 24-Sep 22

VirgoAug 24-Sep 22 LibraSep 23-Oct 23

LibraSep 23-Oct 23 ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22 SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21 CapricornDec 22-Jan 20

CapricornDec 22-Jan 20 AquariusJan 21-Feb 18

AquariusJan 21-Feb 18 PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20