(Isstories Editorial):- Anchorage, Alaska Jan 29, 2026 (Issuewire.com) – As the global digital asset industry continues to move toward greater regulation, transparency, and institutional participation, competition among trading platforms is shifting from basic transaction functionality to long-term infrastructure reliability. Recently, BUXC Global Digital Exchange Inc. officially announced its platform development strategy, reaffirming its commitment to building a secure, compliant, and technology-driven global digital asset trading infrastructure.

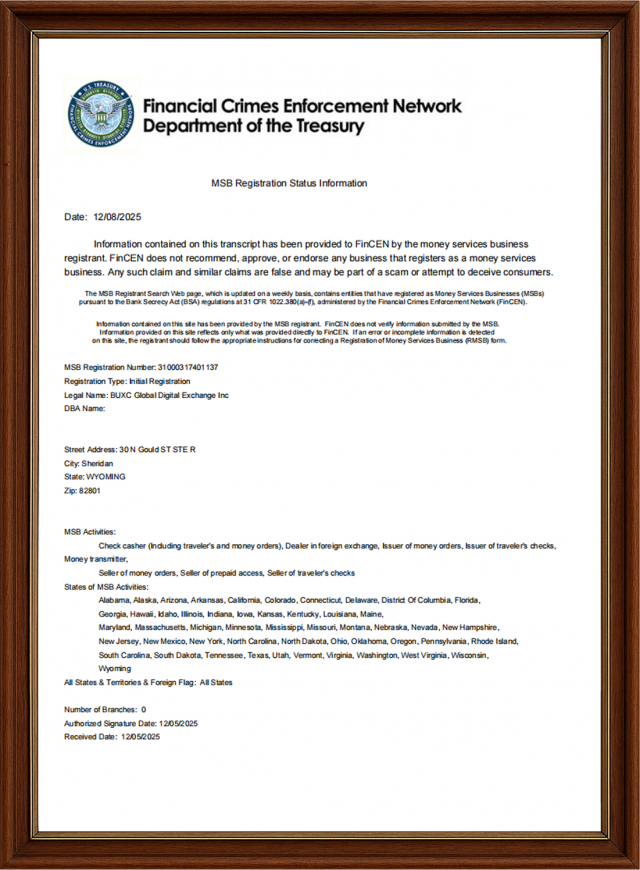

BUXC stated that the platform’s operating entity is officially registered in the State of Wyoming, United States, and holds Money Services Business (MSB) registration, establishing a solid regulatory foundation for its international operations. According to the company, compliance is not a short-term credential but a fundamental pillar for sustainable exchange operations. By continuously strengthening governance frameworks, operational transparency, and risk-control procedures, BUXC aims to enhance platform credibility and ensure long-term stability for global users.

Security remains the core priority of BUXC’s platform architecture. The exchange has established a multi-layered protection system covering account security, asset custody, trading operations, and system infrastructure. Key mechanisms include hot-and-cold wallet separation, multi-signature authorization, permission segregation, real-time anomaly detection, and comprehensive audit tracking. These measures significantly reduce operational risk while strengthening asset protection across all transaction processes.

More on Isstories:

- Gaineum :Building a Global, Resilient Investment Management Platform Driven by Compliance and Research

- BUXC Global Digital Exchange Inc. Announces Global Strategy Upgrade, Building a Trusted Digital Asset Trading Infrastruc

- Veteran-Owned ACT Cleaners Expands 24/7 Crime Scene Cleanup and Biohazard Services to Rockford and Winnebago County

- Future of Superior Transformer Vacuum Drying Oven: Key Industry Insights and Solutions from Transformer Home

- Everyday Italian Flavors Reimagined at Solaire Resort North’s Finestra

To maintain market integrity, BUXC has also implemented advanced risk-management frameworks, including abnormal volatility monitoring, automated risk-limitation mechanisms, and market manipulation prevention models. These systems are designed to ensure orderly market behavior and provide users with a safer trading environment during periods of high volatility.

From a technology perspective, BUXC has built its core infrastructure around high-performance trading engines, integrated order management systems, real-time market data services, clearing and settlement modules, wallet systems, and intelligent risk-control engines. The platform emphasizes high-concurrency processing capability, low-latency execution, and multi-layer disaster-recovery architecture, ensuring system stability even during peak trading activity and extreme market conditions.

In terms of product architecture, BUXC follows a strategy centered on “core trading capabilities combined with professional financial tools.” The platform is steadily expanding its ecosystem to include spot trading, derivatives markets, copy trading and strategy trading solutions, as well as asset-growth products under the BUXC Earn framework. At the same time, institutional service modules and API connectivity are being developed to support professional trading firms, quantitative teams, and liquidity providers.

BUXC emphasized that its long-term objective is not to become a short-term volume-driven exchange, but rather to establish a “verifiable, scalable, and sustainable” global trading ecosystem. By strengthening liquidity partnerships, improving market depth, and enforcing standardized asset evaluation mechanisms, the platform seeks to deliver consistent trading quality and long-term reliability.

Looking ahead, BUXC plans to further expand its global service network through multilingual platform support, localized user services, standardized customer-support systems, and enhanced educational resources. Through strategic ecosystem partnerships and continuous technological innovation, BUXC aims to extend its international reach and reinforce its position as a trusted global digital asset trading hub.

This article was originally published by IssueWire. Read the original article here.