How Inflation Can Be Fixed Without Crushing Jobs

(Isstories Editorial):- Washington, D.C, District of Columbia Jan 27, 2026 (Issuewire.com) – Controlling Inflation

More on Isstories:

- Achieving Precision: China Best High Quality Torx Screws Exporter Fasto Meets High Torque Performance Standards

- Precision in Every Turn: The Evolving Landscape of Torx Screws Solutions in Modern Engineering

- Industrial Powder Coating Mixer Solutions for High-Quality Coatings

- Natural vs. Synthetic: Which China Best Black Iron Oxide Exporter Offers Superior Stability?

- Jamie M. Richardson, Recognized by BestAgents.us as a 2026 Top Agent

Why America’s Inflation Problem Is Structural — and How It Can Be Fixed Without Crushing Jobs

Inflation remains one of the most pressing economic concerns facing the United States, yet the national debate over how to control it remains narrowly focused on interest rates. For more than two years, higher borrowing costs have been treated as the primary solution, even as prices for essentials such as housing, healthcare, insurance, and food remain elevated. The persistence of inflation despite aggressive monetary tightening suggests a deeper problem: much of today’s inflation is structural, not merely monetary.

Inflation is commonly described as too much money chasing too few goods. While that definition applies in limited circumstances, it fails to explain why prices remain stubbornly high even as consumer demand cools. The reality is that many of the largest price increases are embedded in the economy’s cost structure. These costs are passed from producers to consumers regardless of demand conditions, making inflation resistant to traditional remedies.

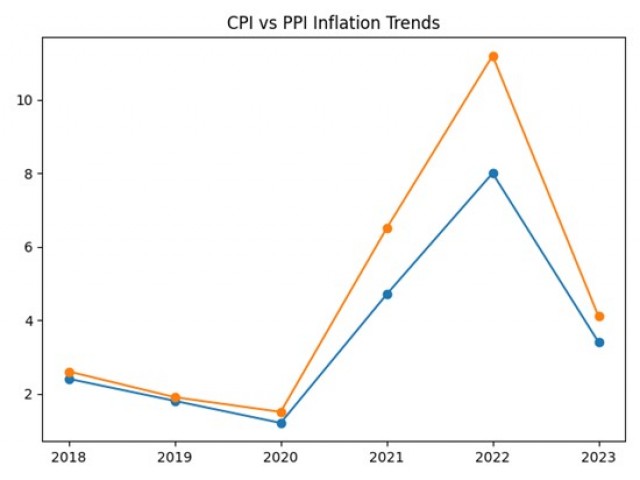

Official measures often obscure this reality. Consumer inflation statistics underweight essential household expenses while excluding asset prices altogether. Producer costs, however, tell a clearer story. Rising input prices appear long before they reach store shelves, revealing inflationary pressure upstream that interest rate hikes do little to relieve.

Chart: CPI vs. PPI Inflation Trends

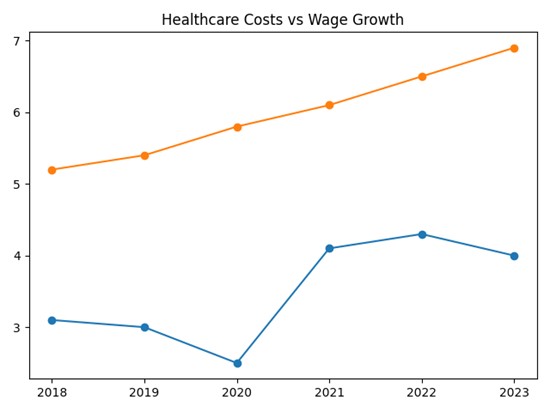

Among the most powerful structural drivers of inflation is the way healthcare is financed in the United States. Employer-sponsored healthcare functions as a hidden tax on labor and production. As premiums rise faster than wages, businesses face higher employment costs while workers experience stagnant pay. These expenses are embedded in the price of nearly every good and service, quietly pushing inflation higher year after year.

Chart: Healthcare Costs vs. Wage Growth

International comparisons highlight how unusual this system is. Other advanced economies finance healthcare broadly through public systems, preventing medical costs from being baked into payrolls and product prices. The result is greater price stability and stronger global competitiveness.

Trade policy is another underappreciated driver of inflation. Tariffs are often described as tools for protecting domestic industry, but in practice, they function as indirect taxes on consumers. When applied broadly or without complementary investment in domestic capacity, tariffs raise costs throughout supply chains. These increases are largely invisible to consumers but become clear at the checkout counter.

Whether tariffs stabilize prices or accelerate inflation depends entirely on how they are designed and applied.

Table: Tariff Policy and Inflation Impact

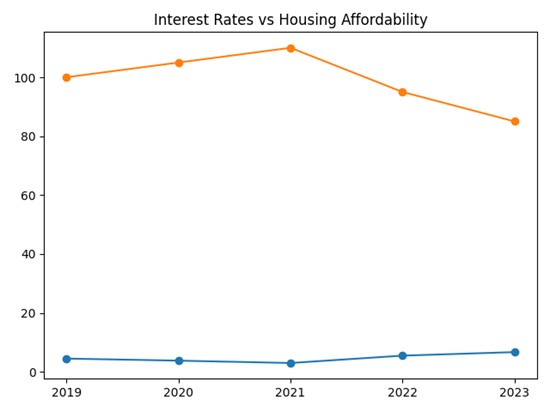

Relying on interest rates to counter these forces has predictable consequences. Higher rates suppress demand but do not remove embedded costs. Housing affordability deteriorates, small businesses delay investment, and supply expansion slows. In effect, rate hikes treat the symptoms of inflation while leaving its causes untouched.

Chart: Interest Rates vs. Housing Costs

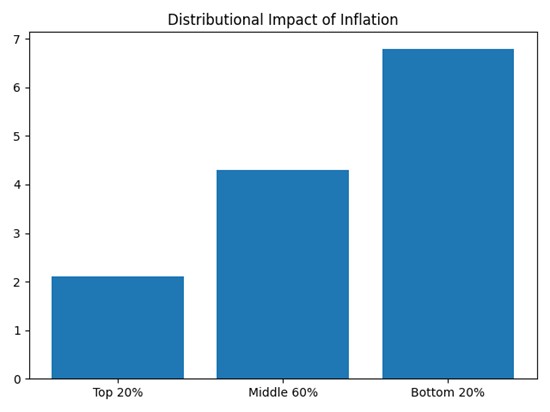

The burden of this approach falls unevenly. Retirees on fixed incomes, wage earners whose pay lags prices, young households trying to enter the housing market, and small businesses with limited pricing power all bear the cost. Inflation, left unchecked or poorly addressed, becomes a quiet but powerful engine of inequality.

Chart: Distributional Impact of Inflation

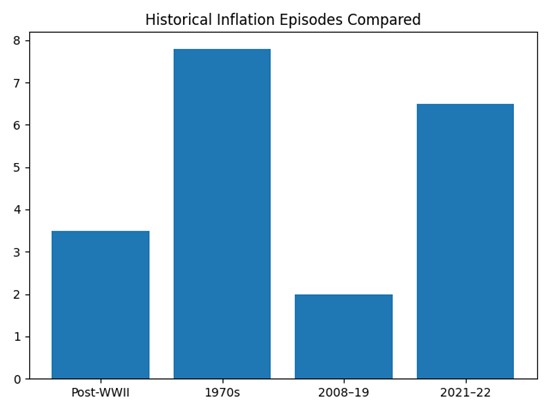

History offers clear lessons. After World War II, inflation was controlled not by suppressing demand but by expanding productive capacity. Factories were built, supply chains strengthened, and wages rose alongside output. By contrast, the inflation of the 1970s was ultimately subdued by aggressive rate hikes that lowered prices but at the cost of long-term industrial decline.

Chart: Historical Inflation Episodes Compared

The Federal Reserve plays a vital role in maintaining financial stability, and its actions during crises have prevented far worse outcomes. But the central bank cannot resolve structural inflation on its own. Its tools are designed to influence credit conditions, not to reform healthcare financing, rebuild manufacturing, or redesign trade policy.

The most successful periods of inflation control have occurred when monetary policy worked alongside congressional action. When lawmakers addressed underlying cost drivers and invested in productive capacity, inflation receded without widespread economic damage.

A more effective strategy for today would focus on removing embedded production costs, rebuilding domestic manufacturing, reforming healthcare financing, and increasing price transparency in concentrated markets. These steps expand supply rather than suppress demand, allowing prices to stabilize while jobs and wages grow.

Chart: Structural Inflation Reduction Tools

Inflation is not just an economic issue; it is a democratic one. Persistent price instability erodes trust in institutions and fuels political polarization. When citizens believe the economy is rigged against them, social cohesion weakens and confidence in governance declines.

The cost of inaction is substantial. Failing to address structural inflation locks in lower real wages, weakens competitiveness, and passes mounting burdens to future generations. By contrast, addressing root causes offers a path to lasting stability without sacrificing prosperity.

Inflation is not inevitable. It is shaped by policy choices. The United States can continue to rely on blunt monetary tools that strain households and businesses, or it can adopt a coordinated approach that tackles embedded costs and restores balance to the economy. History shows that the latter path works–and that the sooner it is chosen, the lower the cost will be.

Roy J. Meidinger

[email protected]

954-790-9407

14893 American Eagle Ct.

http://SavingTheWorld.us

This article was originally published by IssueWire. Read the original article here.