Leveraging open banking, the AI-native fintech app offers an affordable alternative to financial advisors, helping young Britons navigate the cost-of-living crisis with a powerful money management tool.

(Isstories Editorial):- London, United Kingdom Oct 3, 2025 (Issuewire.com) – In a critical move to address the widespread financial anxiety gripping the nation, financial technology innovator Cent Capital Limited today announced the official UK launch of its premier AI finance app. This new money management tool is engineered to help UK Millennials and Gen Z navigate the cost-of-living crisis by providing a powerful, affordable, and user-friendly platform to take control of their financial lives.

More on Isstories:

- Immigrant Entrepreneurship in America by Gorm Tuxen Achieves #1 Amazon Bestseller Status

- Colle AI Formalizes Strategy Around Cross-Chain Asset Versioning Infrastructure.

- Imagen Network Sets Forth Multi-Perspective Rendering Initiative for Immersive Asset Creation

- Apolosign Digital Wall Calendar Tackles “Proxy Parenting” in U.S. Homes

- 25 Countries for Solo Travelers to Discover Themselves

The Cent Capital app is a next-generation personal finance and budgeting app for iOS and Android that functions as an intelligent “financial co-pilot.” It directly answers the growing consumer search for a modern alternative to expensive financial advisors. The platform provides hyper-personalized insights, helping users to track spending, manage credit card debt, and build a clear, actionable plan towards their financial goals.

“The current economic climate has created immense financial pressure, and UK consumers are actively searching for better tools to manage their money,” said Miriam Odabe, Co-Founder & CCO. “We built Cent Capital to be that solution. It is more than just a UK budgeting app; it is a forward-looking partner that provides clarity and confidence. Our mission is to help people move from financial stress to financial wellness with a clear, achievable plan.”

Cent Capital: The UK’s New AI-Powered Personal Finance App

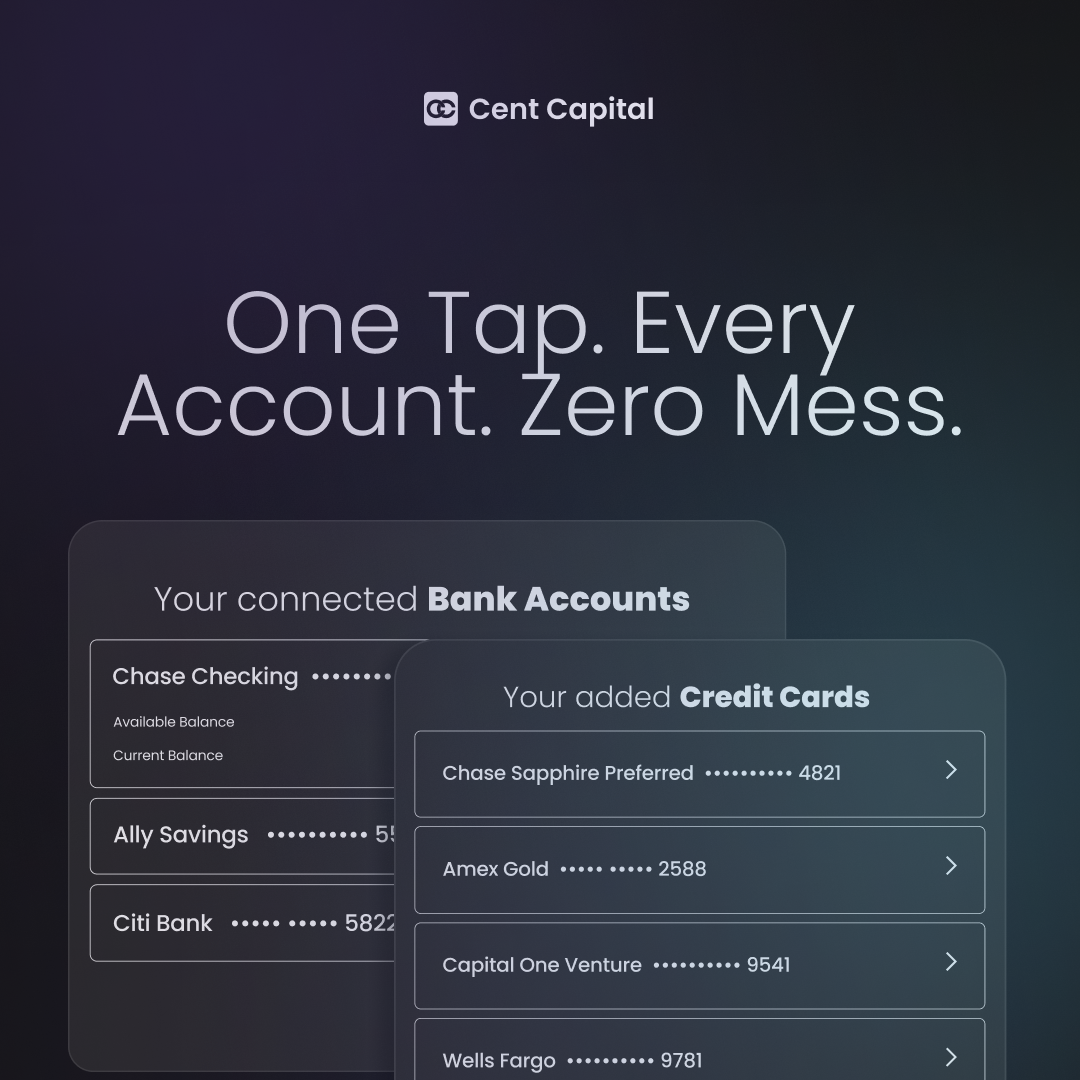

The core problem for many is a fragmented financial life, making it nearly impossible to get a true picture of one’s financial health. Cent Capital is designed to solve this with an all-in-one financial overview.

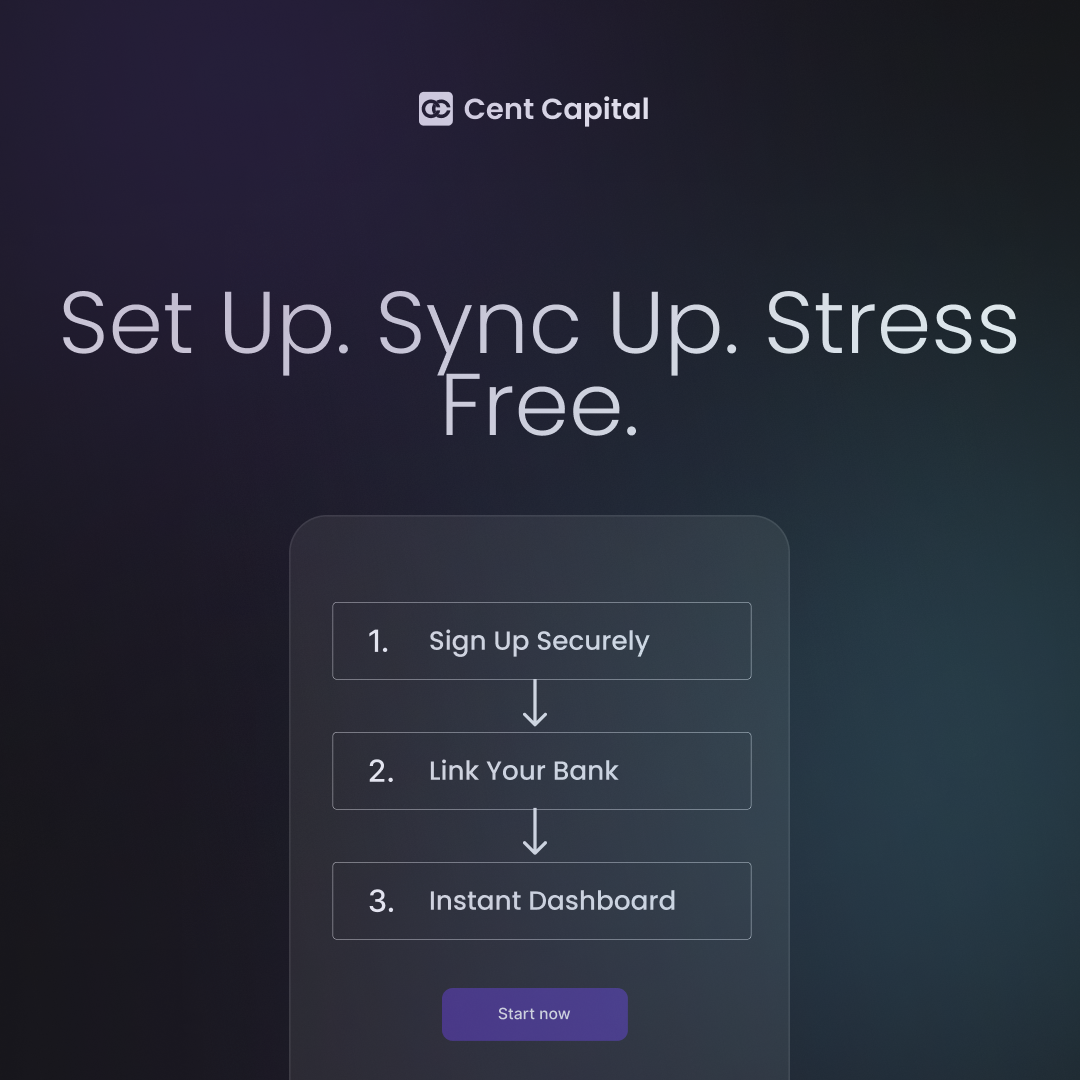

The user journey begins with a simple download and a secure sign-up process. Using trusted and government-supported Open Banking technology, a user can securely connect all their financial accounts. This means linking everything from a UK high-street bank account to a digital challenger bank, credit cards, and savings pots within a single dashboard.

This unified view is the foundational step toward taking back control. The app intelligently categorizes transactions, calculates net worth in real-time, and presents a holistic dashboard that immediately demystifies a user’s financial situation. For the first time, users can see their complete financial world in one place.

An Intelligent Tool to Track Spending and Manage Expenses

Once a user’s accounts are linked, the app’s powerful AI engine gets to work. It analyzes spending habits, income patterns, and debt levels to find opportunities a person might easily miss. Instead of overwhelming users with complex spreadsheets and raw data, the AI delivers a simple, actionable to-do list, prioritizing the top three most impactful steps a user can take right now.

This makes the platform an ideal tool for anyone asking “how to track all my spending in one place?” or “how to start an emergency fund in the UK?” The AI provides personalized, prioritized guidance to make these goals feel tangible and achievable.

A Clear Plan to Manage Debt and Build Savings

For many, debt can feel overwhelming. Cent Capital provides tools to create a clear plan to manage and reduce debt. The AI can identify high-interest credit cards and present strategies for repayment, helping users save money on interest and become debt-free faster. It acts as a proactive guide for anyone seeking help with managing credit card debt.

Simultaneously, the app helps users identify surplus cash flow that can be allocated towards savings goals. By finding small, consistent opportunities to save, the app helps users build a crucial emergency fund and start planning for longer-term investments.

Is It Safe? A Deep Dive into Cent Capital’s Bank-Grade Security

For any finance app, trust is paramount. Cent Capital was built with a “Privacy First” philosophy and a multi-layered security architecture to ensure user data and privacy are always protected.

-

Bank-Grade Security: The platform is powered by the same trusted security protocols used by major international banks.

-

State-of-the-Art Encryption: All user data is protected with AES-256 encryption, the global standard for securing sensitive information.

-

Read-Only Access: The secure connection to your bank is strictly “read-only.” This guarantees that the Cent Capital app can only analyze your financial data to provide insights. No one–not even you–can ever move, withdraw, or touch your money through the app.

An AI That Grows With You: Beyond a Simple Budget Planner

The technology behind Cent Capital is not static. The AI is designed to be a long-term partner, learning and adapting to a user’s financial journey. As a user’s goals change, the AI adjusts its recommendations, making it a dynamic investment app for beginners in the UK who are just starting to think about their long-term future.

“Our mission is to democratize financial wellness,” said Shivam Singh, Founder & CEO of Cent Capital. “We are using AI to make high-quality, unbiased financial guidance accessible to everyone. This is the affordable alternative to a financial advisor that people have been waiting for. Our app is designed to give you the knowledge and confidence to build a better future.”

Meet the Team Behind Your Financial Co-Pilot

Cent Capital was founded by a passionate global team of experienced technologists, designers, and strategists united by a mission to solve real-world financial challenges. The team dedicated to building this tool for you includes:

-

Shivam Singh (Founder & CEO)

-

Miriam Odabe (Co-Founder & CCO)

-

Brijesh Bhalodiya (Co-Founder & CTO)

-

Abhiraj Pattem (Founding Designer & Head of Brand)

-

Parth Palta (Head of Customer Experience)

-

Bryant Burciaga (Advisor, Investments & Strategy)

-

Mayank Agarwal (Advisor, Machine Learning)

Pricing and Availability on iOS and Android

The Cent Capital app is now available for download in the United Kingdom on both the Apple App Store (iOS) and Google Play Store (Android). In line with its mission for accessibility, a subscription costs a simple, transparent, flat rate of just £1 per month with no hidden fees.

About Cent Capital: Cent Capital is a financial technology company dedicated to building the best AI money management tool for improving global financial literacy and well-being. The company’s mission is to make personalized financial guidance accessible and affordable for everyone, helping users everywhere move from financial stress to confidence.

Press Contact: [email protected]

Website: https://cent.capital

Cent Capital

[email protected]

+12026303211

45 Albemarle Street, 3rd Floor, Mayfair, London, W1S 4JL

https://cent.capital

This article was originally published by IssueWire. Read the original article here.