*Experts argue that “contractual adjustments” allow providers and insurers to dodge lawful tax obligations, while the IRS turns a blind eye.*

(Isstories Editorial):- Fort Myers, Florida Sep 16, 2025 (Issuewire.com) – IRS Failure to Enforce Tax Law in Healthcare Raises Questions of Billions in Lost Revenue

More on Isstories:

- Punjabi Singer Harvy Sandhu, born in Punjab’s Hoshiarpur district and now based in Toronto

- From Protector of the Skies to Preserver of Culture: IAF Veteran Anand Kumar Ashodhiya’s Literary Odyssey

- The Science Behind Mettle: Why Athletes Are Switching from International to Indian Brands

- Subie Queen: The Rise of a Ugandan Digital Powerhouse

- Youfa Group: Building the Global Infrastructure Backbone as a Global Leading Carbon Steel Pipe Manufacturer

Experts argue that contractual adjustments, the writing off of amounts not paid by the insurance companies, enable providers and insurers to evade lawful tax obligations, with the IRS remaining indifferent.

This report begins with a critical clarification: the contract between the healthcare provider and the insurance company does not change the price of medical services or goods. There is no valid agreement that creates a negotiated fee for those services. Instead, the agreement functions as a mechanism for determining the amount of the kickback the provider pays to the insurance company in exchange for steering insured members to that provider. This foundational point frames the analysis that follows.

The Internal Revenue Service (IRS), long tasked with ensuring that all businesses pay their fair share of taxes, faces mounting criticism for its failure to enforce federal tax law in the healthcare industry. At the center of the controversy is the widespread practice of “contractual adjustments,” a bookkeeping maneuver that allows hospitals and insurers to write off substantial amounts of billed revenue, reducing reported taxable income.

Despite clear statutory language, Supreme Court precedent, and technical rulings confirming that post-billing write-offs amount to cancellation of debt (COD) income, the IRS has largely failed to act. Observers point to billions of dollars in uncollected tax revenue, unlawful kickback schemes, and systemic price discrimination–all under the IRS’s watch.

The IRS’s Legal Obligations

Under the Internal Revenue Code, accrual-method taxpayers must recognize revenue once the right to collect is fixed and determinable. Healthcare providers, like other businesses, issue bills to patients that create a legal debt enforceable under contract law. Courts–from Spring City Foundry (1934) to Ortiz v. State Farm (2009)–have reaffirmed that billed amounts are taxable revenue.

Yet hospitals routinely record only the negotiated insurance rate as income, dismissing the balance as a “contractual adjustment.” By doing so, they sidestep the requirement to report cancellation of debt income, a clear violation of 26 U.S.C. §§ 61 and 451.

IRS Failure of Enforcement

The IRS has repeatedly been presented with evidence–through whistleblower submissions, Chief Counsel Advice memoranda, and Technical Advice Memoranda such as TAM 200619020–that post-billing write-offs are not valid discounts. Instead, they are cancellations of debt. Nonetheless, the agency has failed to pursue audits, enforce penalties, or clarify binding guidance.

Critics argue this neglect has created a “two-tier tax system”: one in which healthcare giants exploit loopholes with impunity, while ordinary taxpayers are held to strict compliance.

Moreover, by ignoring insurer obligations, the IRS has overlooked the billions in economic value insurers gain by paying below billed charges. Under Kirby Lumber (1931) and Helvering v. American Dental Co. (1943), such relief from liability constitutes taxable income.

Broader Consequences

The IRS’s failure has enabled more than tax avoidance. It has fueled price discrimination–charging patients different prices for the same services–and incentivized illegal steering of patients in violation of the Anti-Kickback Statute and Sherman Act. Patients lose transparency, competition is stifled, and the federal treasury loses revenue at a time of record national debt.

Whistleblowers and legal experts warn that unless the IRS enforces the law equally, public trust in the fairness of the tax system will erode further.

Questions the Public Should Ask Their AI Service

To investigate these issues further, individuals, policymakers, and watchdog groups can leverage AI tools by asking the following targeted questions:

Accrual Accounting & Revenue Recognition

- When must healthcare providers recognize revenue under accrual accounting–at billing or collection?

- Does a patient’s bill create a legally enforceable debt, and what case law supports this?

- How do courts distinguish between an actual discount at billing and a post-billing “contractual adjustment”?

- Who is considered the customer under ASC 606–patient or insurer?

Contracts & Legal Obligations

- How do provider-patient and provider-insurer contracts differ in liability and enforceability?

- Can insurer contracts legally alter a patient’s bill under the Parol Evidence Rule?

- What laws prohibit providers from charging different prices for the same medical service?

Contractual Adjustments vs. Cancellations of Debt

- Are contractual adjustments recognized under the Internal Revenue Code as valid deductions?

- How should amounts written off after billing be treated–contractual allowances, bad debts, or COD income?

- What Supreme Court cases establish that forgiveness of debt is taxable income?

Tax Law Compliance & Penalties

- How do IRC §§61, 108, 162(c), 451, and 6662 apply to providers and insurers?

- Must insurers report economic benefit (COD income) when acquiring healthcare services at below-market rates?

- What penalties exist for substantial understatement of tax liability?

Kickbacks, Steering, and Antitrust

- What does the Anti-Kickback Statute prohibit in insurer-provider relationships?

- How does the Stark Law restrict self-referrals?

- Are kickback-related expenses deductible under tax law?

- How do the Sherman Act and Robinson-Patman Act apply to healthcare pricing?

IRS Guidance & TAMs

- What did TAM 200619020 conclude about contractual allowances and revenue recognition?

- Why is the IRS’s “payer” vs. “customer” terminology misleading in TAM 200619020?

- Are TAMs the binding authority in tax disputes?

Patient Rights & Legal Enforcement

- Do courts uphold that patients remain liable for the full billed amount even if insurers negotiate lower rates?

- How does the Parol Evidence Rule protect patients from insurer contracts altering bills?

- What remedies exist when providers and insurers collude to adjust bills illegally?

Sources of Financial Information to Detect Tax Evasion

To uncover schemes of unreported revenue or misclassified debt cancellations in the healthcare industry, it is critical to examine public documents that disclose financial activities. These records provide evidence of revenue, contractual adjustments, and potential tax avoidance. The most valuable sources include:

1. Annual and Quarterly Financial Reports (SEC Filings)

- Consolidated financial statements (income statement, balance sheet, cash flow).

- Details on revenue recognition, contractual adjustments, and reserves.

- Disclosures of subsidiaries and business segments.

- Where to Find: SEC EDGAR Database (https://www.sec.gov/edgar/searchedgar/companysearch.html).

- Non-Profit Hospitals: Annual audited reports are often filed with state health departments or hospital websites.

2. IRS Income Tax Returns (Form 990 and Corporate Returns)

- Form 990 (Nonprofits): Discloses revenue, expenses, charitable care, executive compensation, and related entities.

- Corporate Returns (For-Profits): Income tax returns (Form 1120). Not generally public, but summaries via IRS SOI or litigation.

- Where to Find: ProPublica Nonprofit Explorer (https://projects.propublica.org/nonprofits) and the IRS website.

3. Medicare and Medicaid Cost Reports

- Annual cost reports filed with CMS include gross charges, contractual allowances, bad debt, and net patient revenue.

- Where to Find: CMS Healthcare Cost Report Information System (HCRIS). Also, state-level Medicaid cost reports.

4. State Insurance Department Filings

- Annual statements and disclosures by insurance companies.

- Include premium income, claims paid, reserves, and statutory adjustments.

- Where to Find: National Association of Insurance Commissioners (NAIC) database and state insurance commissioner websites.

5. Government Oversight Reports

- Independent audits and oversight by federal/state agencies (HHS-OIG, GAO).

- Where to Find: HHS-OIG reports (https://oig.hhs.gov/reports-and-publications/) and GAO Healthcare Reports (https://www.gao.gov/health-care).

By systematically reviewing SEC filings, IRS Form 990s, CMS cost reports, and state insurance filings, investigators can trace discrepancies in revenue recognition, contractual adjustments, and debt cancellation. These public records form the evidentiary basis for identifying and proving tax evasion schemes by hospitals and insurance companies.

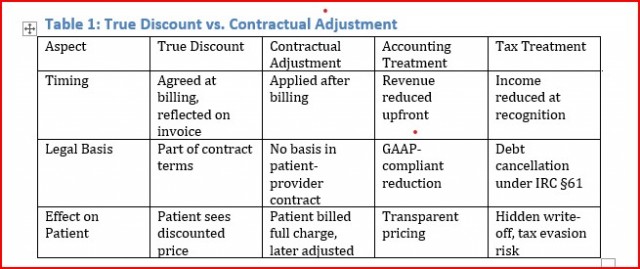

Comparison Table

Table 1 shows that an actual discount is a legitimate price reduction that is agreed upon at the time of billing, clearly reflected on the patient’s invoice, and treated correctly in both accounting and tax law as reduced revenue. By contrast, a contractual adjustment is applied only after billing, has no basis in the patient-provider contract, and is treated as a hidden write-off. Under GAAP, it reduces reported income, but for tax purposes, it functions as a cancellation of debt under IRC §61. The result is that patients see the full charge, not the real discounted amount, creating the risk of misreporting, concealment, and potential tax evasion.

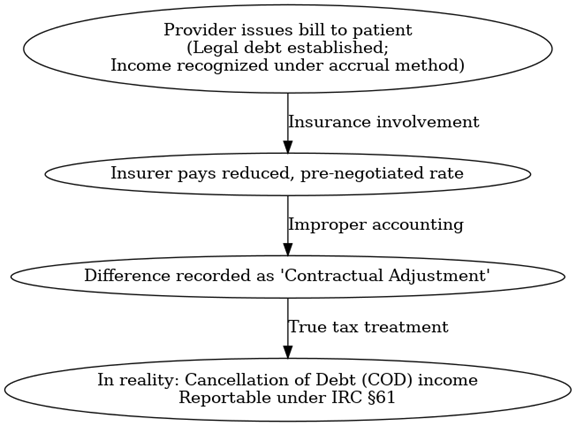

Flowchart: Healthcare Billing and Contractual Adjustment Process

The process begins when the provider issues a bill to the patient. This bill establishes the legal debt and should be recognized as income under the accrual method. If an insurer later pays a reduced, pre-negotiated rate, the difference is improperly recorded as a ‘contractual adjustment’. In reality, this is cancellation of debt (COD) income, which must be reported separately under IRC §61.

Conclusion

In conclusion, the evidence demonstrates that the contract between providers and insurance companies does not alter the actual price of medical services or goods, nor does it establish a lawful negotiated fee. Instead, these agreements define the amount of the kickbacks paid by providers to insurers for directing patients to their networks. Recognizing this reality is essential to enforcing tax and antitrust laws, protecting patients, and restoring integrity to the healthcare system.

Saving the World

[email protected]

954-790-9407

14893 American Eagle Ct.

http://SavingTheWorld.us

This article was originally published by IssueWire. Read the original article here.