(Isstories Editorial):- Apache Junction, Arizona Aug 11, 2025 (Issuewire.com) – Originally established in 1996, Royoso International Investment Group LLC, headquartered in the United States, is a family office with over three decades of experience managing intergenerational wealth and diversified global investment portfolios. Today, Royoso has a renewed focus on AI-driven asset management and blockchain innovation.

Currently, Royoso manages over $118 billion in assets and operates in 16 financial centers worldwide, serving high-net-worth individuals, hedge funds, family offices, and institutional investors. The company’s reimagined platform combines intelligent trading systems with a globally compliant infrastructure, pioneering a new financial model that blends technology and transparency.

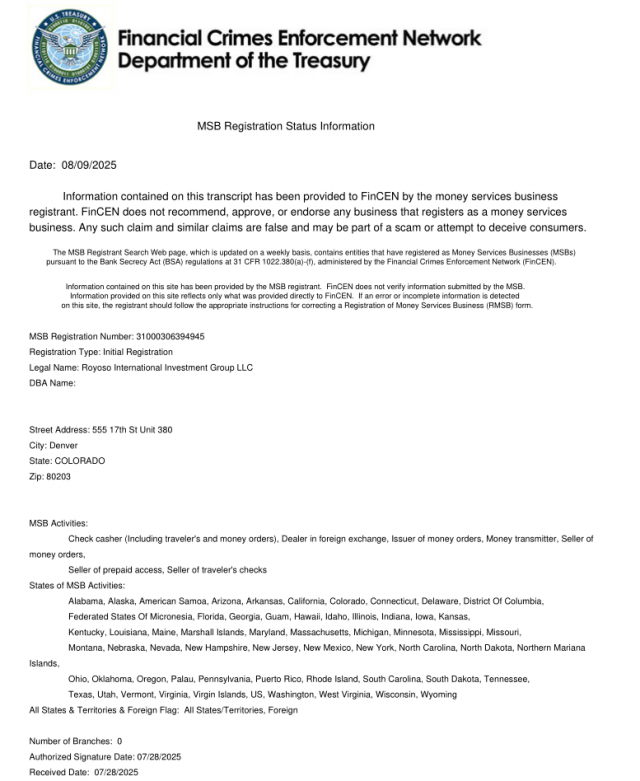

Royoso’s competitive edge lies in its proprietary AI trading engine, which combines real-time big data processing with behavioral modeling. Operating 24/7, it delivers high-precision, risk-managed investment strategies tailored to dynamic markets. The firm is fully licensed under the U.S. FinCEN MSB framework and adheres to KYC/AML, FATCA/CRS, and GDPR standards, safeguarding both capital and compliance.

More on Isstories:

- 9 Million Clicks – 2M DOWNLOADS: ATAKAN ROMANO’S MEMOIR Unmasks BEAUTY’S BLOODY BATTLES – GRAB IT BEFORE PRICE SPIKES!

- Joe Darwish, Recognized by BestAgents.us as a 2026 Top Agent

- Nanci Isaacs, Recognized by BestAgents.us as a 2026 Top Agent

- Heidi Pfeffer-Morgan, Recognized by BestAgents.us as a 2026 Top Agent

- Brooke Lovelady, Recognized by BestAgents.us as a 2026 Top Agent

In addition, Royoso is expanding deeply into blockchain innovation, collaborating with global leaders such as Skyux Web3 Exchange, DataRobot, DeepMind, and Jane Street to build the future of on-chain asset management, AI-based financial analysis, and digital securities.

From its roots in legacy wealth management to its role as a smart capital platform, Royoso is redefining what it means to invest globally–bridging traditional finance and next-generation technologies.

This article was originally published by IssueWire. Read the original article here.