(Isstories Editorial):- Road Town, Tortola May 31, 2025 (Issuewire.com) – Ripple’s XRP token is maintaining a price above $2.10 despite recent market volatility, as the U.S. Securities and Exchange Commission (SEC) formally reviews WisdomTree’s proposed spot XRP ETF. This development has sparked optimism among investors, suggesting potential for increased institutional adoption.

Simultaneously, StratoVM ($SVM), a Layer-2 solution aiming to bring smart contracts and AI capabilities to Bitcoin, has experienced a remarkable 2,939% surge over the past three months. This growth is fueled by the expanding Bitcoin DeFi (BTCFi) sector, which has seen total value locked (TVL) rise significantly.

XRP Price Outlook: ETF Review Sparks Institutional Interest

More on Isstories:

- Level Up Garage Door Pros Delivers Expert Garage Door Services in League City, TX

- Tips for Wedding Photos: How Lily – Lime Helps Couples Capture Their Big Day Beautifully

- Local Cleaning Services Sets the Standard for Carpet – Upholstery Cleaning in Los Angeles, CA

- 2Quick Garage Doors Woodlands Provides Trusted Garage Door Services in The Woodlands, TX

- From Babble to Reading Carrie Peoples’ Reading System Empowers Children to Learn Through Simplicity and Play

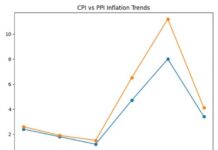

On May 30, XRP’s price dipped to $2.10 amid broader market fatigue. Despite this, the token has shown resilience, with bulls defending key support levels. The SEC’s evaluation of WisdomTree’s spot XRP ETF, which would list on the Cboe BZX Exchange, has reignited discussions around XRP’s regulatory status and potential for institutional investment.

Technical analysis indicates a falling wedge pattern, typically a bullish reversal structure. A sustained move above immediate resistance levels, particularly near $2.37, could pave the way for a rally towards the $2.57 target.

StratoVM ($SVM): The Layer-2 Breakthrough Transforming Bitcoin into a DeFi, AI, and Smart Contract Powerhouse

Bitcoin remains the largest and most secure blockchain, but its capabilities have traditionally been limited to serving as a store of value. Unlike Ethereum or Solana, Bitcoin hasn’t natively supported smart contracts, DeFi applications, or NFTs–leaving it out of the programmable finance revolution.

StratoVM ($SVM) aims to bridge this gap. As a next-generation Layer-2 solution, it’s designed to bring DeFi, AI integration, and smart contracts to Bitcoin’s base layer–without compromising security.

Since its mainnet launch, StratoVM has gained significant traction. The token has surged by 2,939% over the past three months, now trading at approximately $0.041. This growth reflects increasing interest in Bitcoin-based infrastructure plays.

StratoVM currently holds a market capitalization of around $5.08 million, a tiny fraction compared to peers like CoreDAO, which boasts a market cap of approximately $701.9 million. The disparity suggests room for growth potential if StratoVM continues gaining traction in the emerging Bitcoin DeFi (BTCFi) space.

The BTCFi sector is experiencing rapid growth. According to DeFiLlama, total value locked in BTCFi has exploded from $307 million to $5.85 billion in the past year alone–a clear signal of demand for Bitcoin-native innovation.

StratoVM is already live on Uniswap, with rumors circulating about an upcoming centralized exchange (CEX) listing. Backed by over 50 strategic partners, the project is building strong momentum across the ecosystem. Its testnet activity also reflects growing user interest, boasting over 113,000 wallets and processing 56,000 daily transactions–early signs of real-world adoption.

If the project delivers on its vision, StratoVM could radically reshape Bitcoin’s role in the broader crypto ecosystem–transforming it from digital gold into a programmable financial layer supporting DeFi, smart contracts, and AI-powered applications.

The Takeaway

As XRP navigates regulatory developments and seeks to solidify its position in institutional portfolios, StratoVM offers a compelling narrative in the evolving Bitcoin DeFi landscape. Crypto enthusiasts may find opportunities in both assets: XRP for its potential institutional adoption and StratoVM for its innovative approach to enhancing Bitcoin’s functionality.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risks, and readers should conduct their own research before making investment decisions.

This article was originally published by IssueWire. Read the original article here.