Risk management in crypto requires going beyond price charts and volume. It requires the use of robust alternative data, sourced from companies founded by veteran traders.

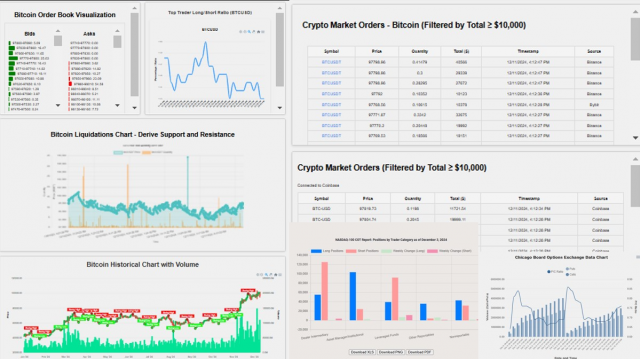

(Isstories Editorial):- New York City, New York Dec 21, 2024 (Issuewire.com) – AlternativeMarketData.com, the leader in alternative data solutions, is transforming how investors and traders manage risk in the cryptocurrency market. By leveraging innovative metrics such as Total Value Locked (TVL) in decentralized exchanges, large whale orders from centralized exchanges, and order flow analysis, the platform empowers users with unparalleled insights to navigate the volatile crypto landscape.

More on Isstories:

- Burj2Burj 2026 Confirms Its Place as Dubai’s Iconic Half-Marathon

- Valentine’s Day Style Guide: How to Choose the Right Wig from Isee Hair

- What Is a Good Offline Puzzle Game for Mobile? — Sudoku – Classic Sudoku Puzzle

- A Legacy of Excellence: How CHENPIN’s Certified High Quality Food Machine Solution Global Standards

- HBMHCW Aligns with SEC Tokenized Securities Guidance and MiCA Licensing Standards

As the cryptocurrency ecosystem matures, traditional data points alone are no longer sufficient to predict market trends or manage risks effectively. AlternativeMarketData.com fills this gap by providing granular, actionable intelligence that enhances decision-making for both institutional and retail participants.

“Risk management in crypto requires going beyond price charts and volume,” said Lionel, Founder of AlternativeMarketData.com. “By tracking TVL, whale activity, and order flow, we enable traders to identify potential market moves, mitigate risks, and capitalize on opportunities.”

Key Features of AlternativeMarketData.com:

- Total Value Locked (TVL): Measure the aggregated value of assets locked in decentralized protocols to gauge market confidence and liquidity. Some examples include Uniswap.

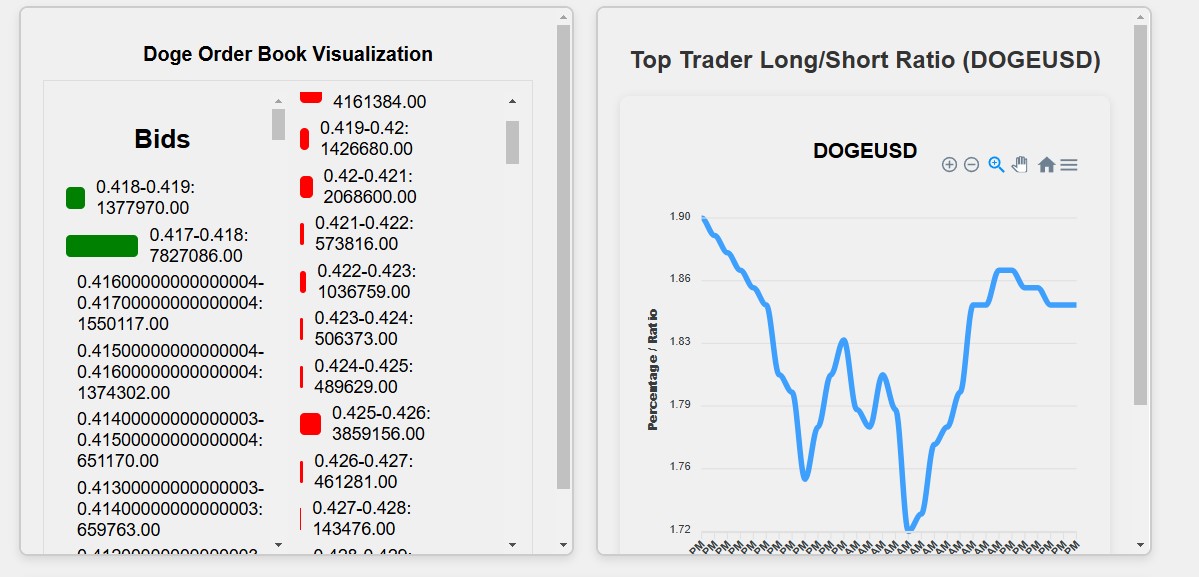

- Whale Orders Tracking: Monitor large transactions on centralized exchanges to identify potential market shifts caused by high-net-worth individuals or institutions.

- Order Flow Analysis: Understand buying and selling pressure to anticipate price trends and manage entry/exit points.

These innovative data streams are invaluable for identifying trends, predicting market movements, and mitigating exposure to sudden volatility. Whether it’s detecting a potential liquidity crisis or spotting institutional buying activity, AlternativeMarketData.com ensures its clients stay ahead of the curve.

About AlternativeMarketData.com

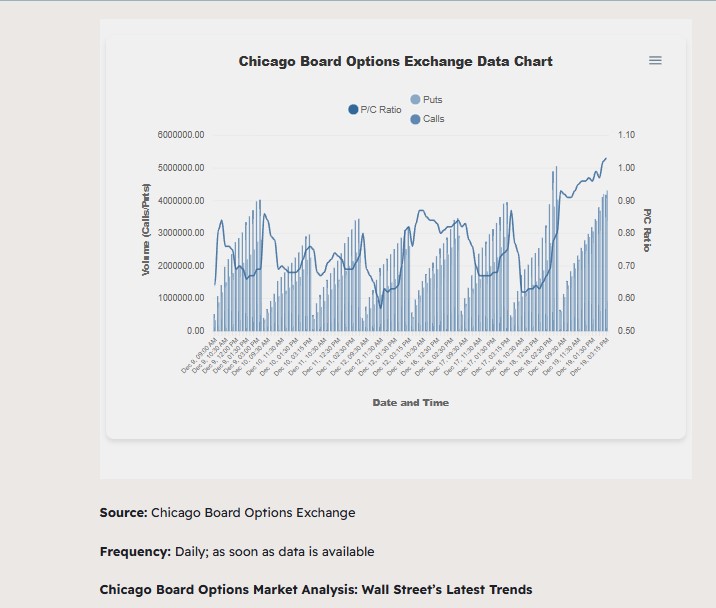

AlternativeMarketData.com is the global leader in alternative data solutions for the cryptocurrency market. The platform covers U.S. indices such as the Nasdaq and also Chicago options. The team believes that monitoring U.S. options data is key to understanding the next move in cryptocurrency. For example, the team highlighted to some of its users that the U.S. Chicago Options market had a Put-to-Call Ratio above 1 as of yesterday, signaling a potential crypto correction. With a commitment to empowering traders and investors, the platform provides cutting-edge alternative data insights that redefine how risks are managed in the world of digital assets.

Alternative Market Data

[email protected]

84689538

Bedok 410

https://alternativemarketdata.com/

This article was originally published by IssueWire. Read the original article here.