Strategic Financial Position and Strengthened Governance Frameworks Set the Stage for OV9’s Transition to Public Markets, Driving Long-Term Value Across ASEAN

(Isstories Editorial):- Hong Kong, Hong Kong S.A.R. Nov 4, 2024 (Issuewire.com) – OV9 Infinity Limited , a promising trading and investment firm in the ASEAN market, announced today the successful securing of a $588 million credit and trade facility from Deutsche Bank. This facility reinforces OV9’s capital structure and provides essential liquidity to support its expanding operations across Southeast Asia.

More on Isstories:

- How Apolosign’s Dual-System Digital Calendar Is Shaping the Future of Family Time

- Trellissoft Launches AI Operational Readiness Assessment Service

- FurGPT Deploys Multimodal Intelligence to Enable Natural AI Companion Engagement

- Atua AI Builds Real-Time Control Models to Improve Multichain Coordination

- Florida’s Roofing Revolution: How HomeX is Transforming the Way Homeowners Protect Their Homes in 2025

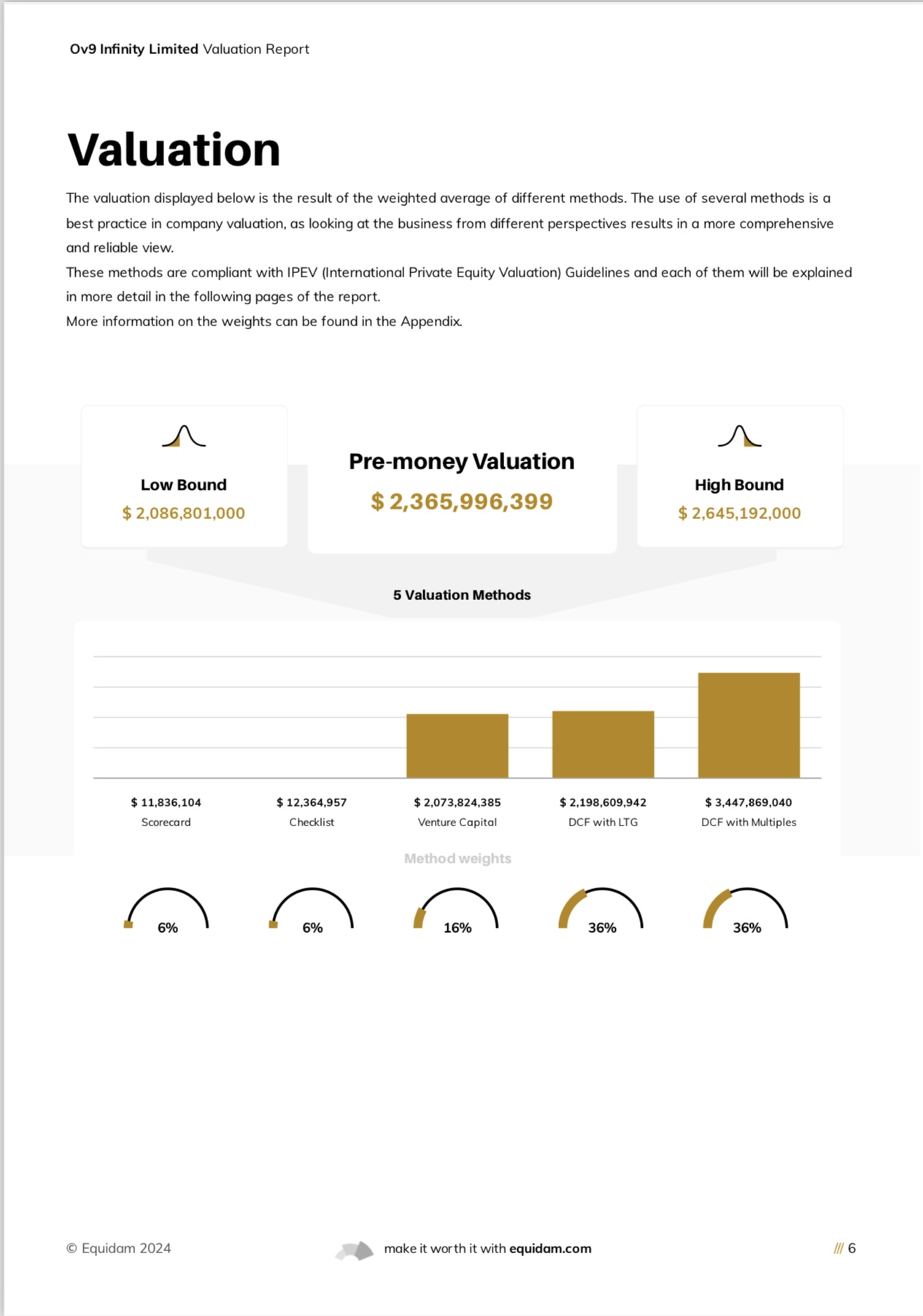

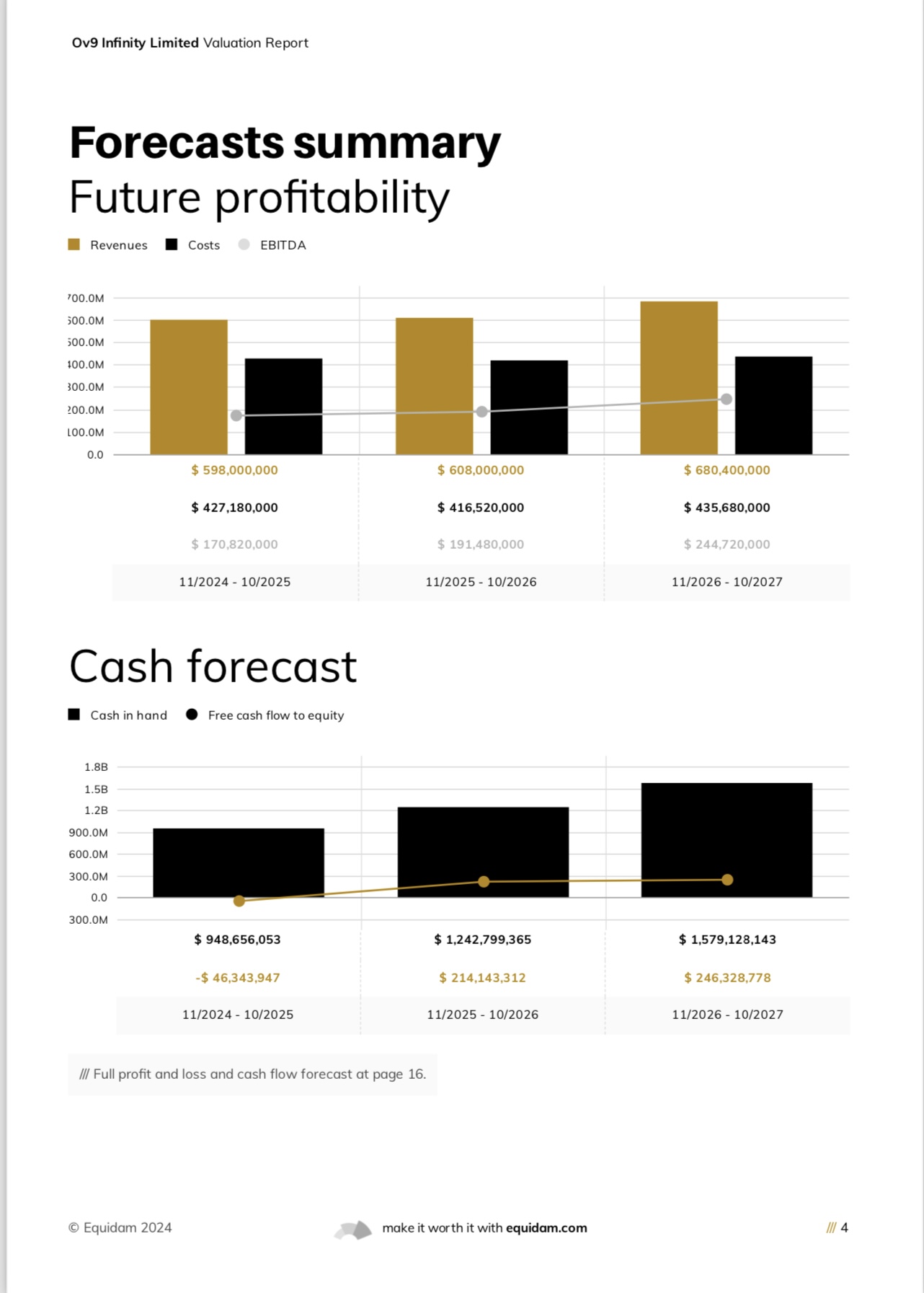

The valuation of OV9 Infinity Limited, meticulously conducted by Equidam, places the company at approximately $2.4 billion. A majority share–75%–is held by Oum Valentin, whose long-term vision and commitment have been instrumental in OV9’s trajectory. This financial stake underlines the scale of OV9s achievements but is considered a strategic asset rather than a personal milestone for Oum Valentin, who remains focused on OV9’s growth.

Strategic Financial Position and Deutsche Bank Facility

The $588 million facility from Deutsche Bank provides OV9 Infinity with substantial liquidity and operational flexibility, ensuring the company can fulfill its current contractual obligations and pursue growth initiatives independently of immediate external funding. With this stable capital framework, OV9 can continue its mission to bridge ASEAN resources with global markets and expand its reach across strategic industries, without additional reliance on investor funding at this stage.

Commitment to Transparency and Future Public Listing Standards

As OV9 prepares for a public listing, the company is focused on ensuring transparency and alignment with public company standards, encompassing robust governance and compliance practices. Key initiatives in this strategic direction include:

Enhanced Financial Reporting: Regular updates on financial performance, contractual milestones, and operational developments will provide stakeholders with comprehensive insights into OV9’s growth and strategic plans.

Governance and Compliance Strengthening: OV9 is implementing best practices in internal controls and compliance frameworks to align with regulatory standards, reinforcing the company’s operational integrity and ensuring readiness for future public listing requirements.

Leveraging Strategic Partnerships: With the backing of Deutsche Bank, OV9 maintains strong liquidity to meet the demands of high-volume contracts and execute on key opportunities across the ASEAN market.

Financial Outlook and Growth Trajectory

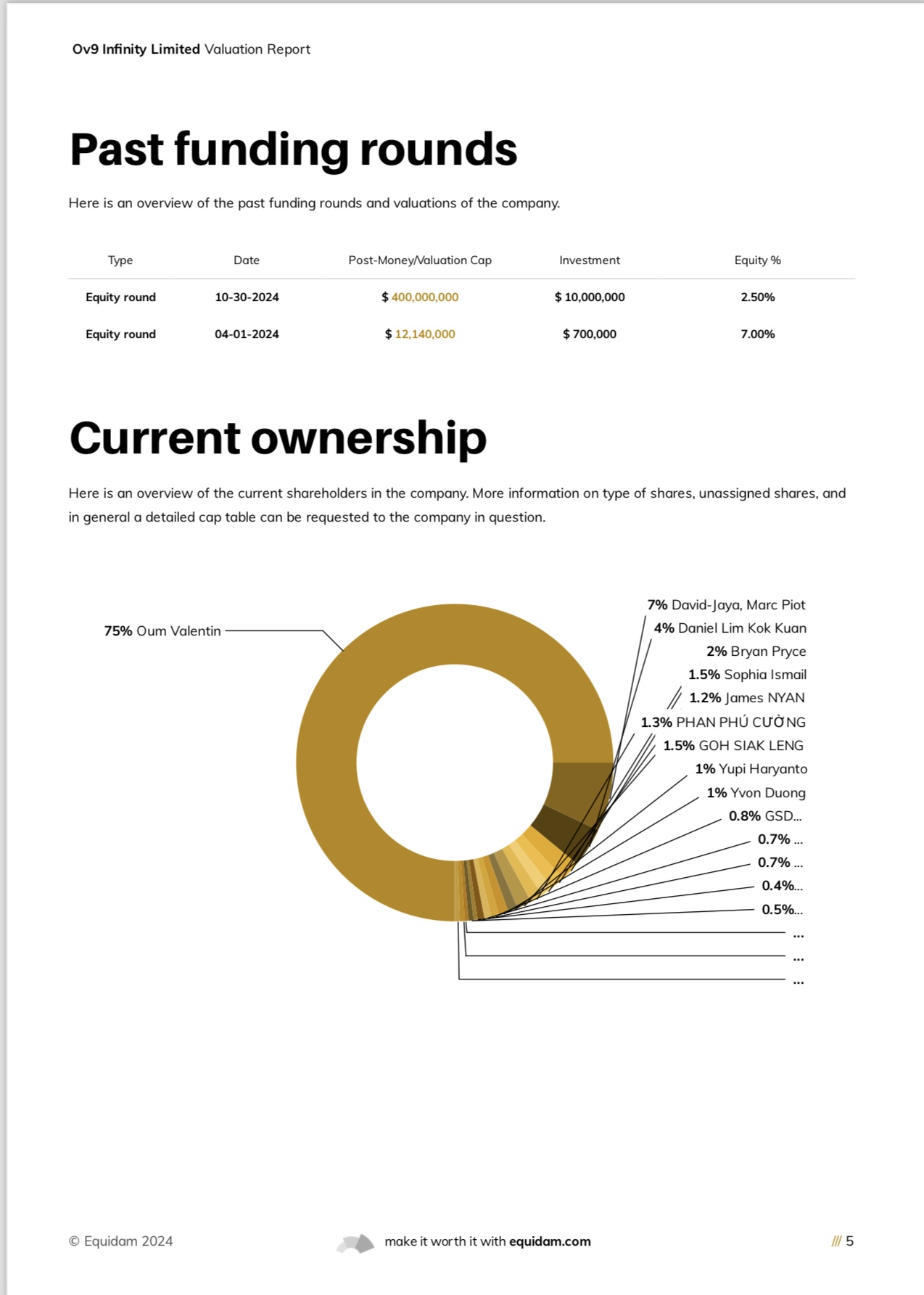

OV9’s projected revenues are set to surpass $680 million by 2026-2027, with an EBITDA forecast of $244 million, reflecting the company’s disciplined approach to capital allocation, operational efficiency, and long-term sustainable growth. This financial trajectory reinforces OV9‘s position as a trusted partner within ASEAN and a key contributor to the region’s economic development.

Disclaimer

This valuation report has been meticulously prepared using a comprehensive collection of authenticated, regionally compliant documents. All data, contracts, and documentation referenced have undergone extensive validation to meet the highest standards of transparency, accuracy, and due diligence as recognized in Cambodia, Hong Kong, and across ASEAN.

The information provided herein is based entirely on verifiable contractual agreements and official records, certified by OV9 Management to ensure adherence to regulatory standards applicable within the ASEAN region. The methodologies employed comply with internationally accepted financial analysis practices and align with local requirements, delivering a credible and reliable evaluation.

This report reflects OV9’s commitment to excellence in documentation, validation, and analysis, crafted specifically to support stakeholders within ASEAN markets. Projections, valuations, and statements are based solely on authenticated evidence, upholding principles of integrity and transparency essential to business operations in these jurisdictions. These methods comply with IPEV (International Private Equity Valuation) Guidelines.

This article was originally published by IssueWire. Read the original article here.