The Entirety of the State of Illinois Judiciary Can Never Fix: Follow The Money

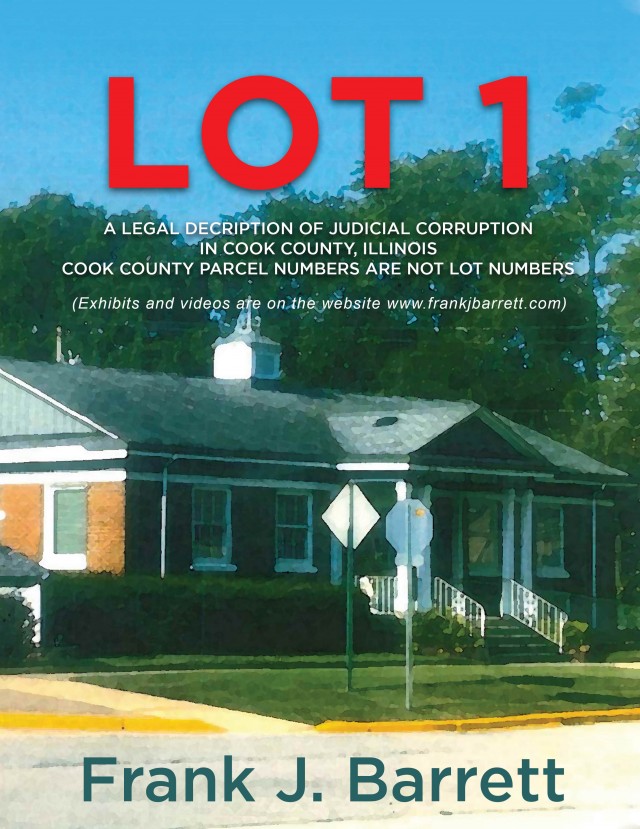

(Isstories Editorial):- Chicago, Illinois Nov 10, 2023 (Issuewire.com) – In a recent legal case that garnered significant attention in Illinois, the State’s judiciary system faced a complex legal issue. The case in question, Byline Bank f/k/a North Community Bank v. Frank J. Barrett et al (Case No. 18CH 13221), showcased the intricacies of mortgage foreclosure, property rights, and judicial proceedings. The property, located at 1600-1606 Westchester Boulevard, is a single-story mixed-use building that includes both commercial and residential space. However, Byline Bank has fraudulently claimed that the building is two separate buildings on two separate lots. This situation unfolded when the mortgagors, Frank J. Barrett and Darlene A. Barrett, allegedly defaulted on their mortgage obligations. Byline Bank, as the plaintiff, sought legal remedies through the Illinois Mortgage Foreclosure Law, aiming to foreclose on the mortgaged properties. The court approved the report of sale and distribution, confirming the sale of the properties. The property dispute has brought to light allegations of fraudulent actions by a major bank, Byline Bank, and its attorney, Scott Kenig. The case, presided over by Judge Edward Robles, centers around discrepancies in the legal description of a property and the alleged consequences of these discrepancies. Barrett, argues that their property was wrongly seized by the bank for significantly less than its actual fair market value of $580,000.

More on Isstories:

- Karen Leonard, Recognized by BestAgents.us as a 2024 Top Agent

- Tim Netzley, Recognized by BestAgents.us as a 2024 Top Agent

- Dennis Jones’ Much Anticipated New Release “About Time” Coming June 28, 2024

- Salvation Army of Broward County Reports Severe Shortage of Food Seeks Urgent Donations

- Controversial New Book Hits #1 Before Release!

Property Claim Key points:

- The property is subject to certain covenants, conditions, and restrictions, as well as general real estate taxes for the year 1990. The property owners released and waived all rights under the Homestead Exemption Laws of the State of Illinois.

- The property is associated with several Permanent Real Estate Index Numbers, including 15-21-301-059, 15-21-301-141, and 15-21-301-190.

- The property address is 1600 Westchester Boulevard, Westchester, IL 60153.

- The document includes the signatures of individuals named Melvin R. Genaze and Mary T. Genaze, who appeared before a Notary Public.

- There is a reference to the construction and features of the property, including an attached medical office building and a detached garage.

- It appears that residential use is also present in one of the properties, and there is information about zoning and legal nonconforming use.

- The document mentions the construction date of the structure as April 1954.

- There is information about the properties being surveyed and analyzed in detail, including site dimensions, topography, and shape.

- The document references a court order appointing a receiver for the non-residential property as part of a mortgage foreclosure case involving Byline Bank (formerly known as North Community Bank) and various defendants, including Frank J. Barrett and Darlene A. Barrett.

Claim from Property owners

- The property owners assert that their property, 1600-1606 Westchester Boulevard, is a single, mixed-use building located on Lot 1. Byline Bank and Scott Kenig, their attorney, insist that two separate buildings on distinct lots are involved.

- The property owners claim that Byline Bank and Scott Kenig knowingly misrepresented the property’s legal description to facilitate foreclosure, potentially affecting the fair market value.

- The property owners argue that the wrongful foreclosure could set a dangerous precedent for future cases where the fair market value of a mortgagor’s property far exceeds their mortgages

The property owner provides a number of pieces of evidence, including:

- A plat of survey and warranty deed that shows the property to be a single lot.

- Photographs of the property show it to be a single building.

- A Cook County Assessor’s inspection report identifies the property as a single building.

- A restricted appraisal report prepared by Byline Bank’s own attorney identifies the property as a single-building

Westchester, IL – Byline Bank, an Illinois banking corporation, announced today that it has appointed Antje Gehrken of A.R.E. Partners in Chicago, Illinois as receiver for the non-residential property located at 1600 Westchester Boulevard, Westchester, Illinois 60154. The property is the subject of Byline Bank’s foreclosure action against defendants Frank and Darlene Barrett. The defendants defaulted on their mortgage obligations, and Byline Bank filed a complaint seeking to foreclose the mortgage. The court granted Byline Bank’s motion for the appointment of a receiver, finding that there is a reasonable probability that Byline Bank will prevail on a final hearing in the matter and that the defendants have not shown good cause why the receiver should not be appointed. As a receiver, Ms. Gehrken will take possession of the property and manage it as would a reasonably prudent person. She will be responsible for collecting rent, paying expenses, and maintaining the property. The appointment of a receiver is a common step in mortgage foreclosure cases involving non-residential properties. So, the fraudulently procured receivership ended in December 2022.

Despite this evidence, Byline Bank has continued to claim that the property is two separate buildings. This claim has allowed the bank to illegally foreclose on the property and seize it for far less than its fair market value. The new evidence that has been uncovered shows that Byline Bank’s foreclosure of this property was a deliberate act of fraud. The bank has knowingly misrepresented the nature of the property in order to take it away from its owners.

This case is a clear example of how banks can abuse their power and exploit homeowners. Byline Bank has shown that it is willing to lie and cheat in order to get what it wants. We call on Byline Bank to immediately return the property to its rightful owners. We also call on the authorities to investigate this case and hold Byline Bank accountable for its actions. Finally, Barret, the property owner is now in total possession of their property while the fraudulent foreclosure is under appeal.

The overarching message is that following the money and understanding the legal system is essential when navigating foreclosure, real estate, and property rights. It’s a reminder that legal processes should be diligently followed to ensure fair and just outcomes in property-related legal disputes. As we await further updates on this case and other related matters, it is important for all stakeholders to demand clarity, transparency, and accountability within the legal system. This case highlights the importance of upholding the principles upon which our judicial system is founded: fairness, transparency, and adherence to the rule of law.

For more information, please contact [email protected]

Get the book: https://www.amazon.com/LOT-DECRIPTION-JUDICIAL-CORRUPTION-ILLINOIS/dp/1960093436/

Website: www.frankjbarrett.com/

This article was originally published by IssueWire. Read the original article here.