If you are looking to improve your credit score, there are several simple steps you can take to get started. In this blog post, we will discuss 6 simple ways to improve your personal credit score.

(Isstories Editorial):- Fort Lauderdale, Florida Apr 11, 2023 (Issuewire.com) – Client Dispute Manager Software:

More on Isstories:

- Joseph Ruiz, Recognized by BestAgents.us as a 2024 Top Agent

- Lori Martin, Recognized by BestAgents.us as a 2024 Top Agent

- Aseel Hadi, Recognized by BestAgents.us as a 2024 Top Agent

- Launching New Book and Website Dedicated to Car Accidents and How to Receive Legal Representation

- Peninsula Security Doors and Window Screens Introduces Premium Phantom Screens and Vista Security Screens in LA

As you go through life, your credit score is one of the most important numbers you will have to keep track of. Whether you are renting an apartment, buying a car, or applying for a mortgage, your credit score plays a crucial role in determining your financial options. Having a high credit score will give you access to better interest rates and more financial opportunities, while a low credit score can make it difficult to get approved for loans and credit cards. If you are looking to improve your credit score, there are several simple steps you can take to get started. In this blog post, we will discuss 6 simple ways to improve your personal credit score.

1. Check Your Credit Report Regularly

The first step in improving your credit score is to understand where you currently stand. You can do this by checking your credit report, which is a detailed summary of your credit history. Your credit report will show you all of the accounts you have open, any missed or late payments, and any outstanding debts. By reviewing your credit report regularly, you can identify any errors or inaccuracies that may be hurting your credit score.

2. Dispute Errors on Your Credit Report

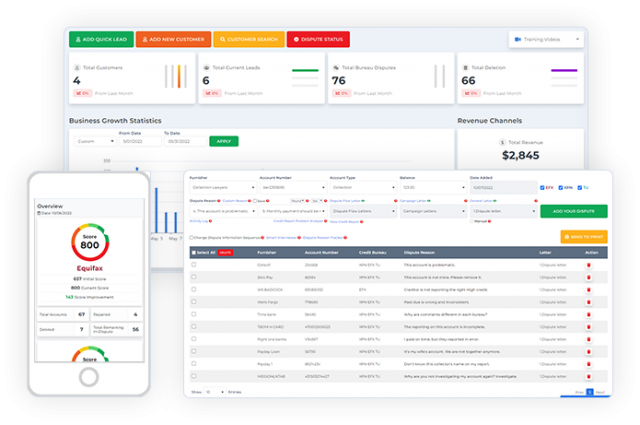

If you find errors on your credit report, it is important to take action to dispute them. Even small errors can have a significant impact on your credit score, so it is important to address them as soon as possible. Using client dispute manager software, you can dispute errors on your credit report. This software will help you identify any errors on your credit report and guide you through the dispute process.

When disputing errors on your credit report, it is important to provide as much evidence as possible to support your claim. This may include copies of bank statements, receipts, or other documents that prove your case. By providing strong evidence, you can increase your chances of having the error removed from your credit report.

3. Pay Your Bills on Time

One of the most important factors in determining your credit score is your payment history. Late or missed payments can have a significant negative impact on your credit score, so it is important to pay your bills on time. This includes credit card payments, mortgage payments, and any other bills you may have.

If you struggle to remember to make payments on time, many credit card companies and banks offer automatic payment options, which can help ensure that your payments are made on time every month. You can also set up reminders on your phone or computer to help you remember to make your payments.

4. Keep Your Credit Card Balances Low

Another important factor in determining your credit score is your credit utilization ratio. This is the amount of credit you are using compared to the amount of credit you have available. Ideally, you should keep your credit utilization ratio below 30%. For example, if you have a credit card with a $10,000 limit, you should aim to keep your balance below $3,000.

If you are struggling to keep your credit card balances low, there are several strategies you can use. One option is to make more frequent payments throughout the month, rather than waiting until your due date. This can help keep your balances low and reduce your credit utilization ratio. Another option is to request a credit limit increase, which can help increase the amount of credit you have available.

5. Avoid Opening too Many New Accounts

While having a mix of credit accounts can be beneficial for your credit score, it is important to avoid opening too many new accounts at once. When you apply for a new credit card or loan, the lender will typically perform a hard inquiry on your credit report. Too many hard inquiries can have a negative impact on your credit score, so it is important to be selective when applying for new credit.

If you are considering opening a new credit account, it is important to do your research and choose a reputable lender. You can use credit repair software to help you compare different lenders and their offerings. When applying for a new account, be sure to read the terms and conditions carefully to understand the fees, interest rates, and repayment terms.

6. Work with a Credit Repair Business

If you are struggling to improve your credit score on your own, you may want to consider working with a credit repair business. These companies specialize in helping individuals improve their credit scores by identifying errors on their credit reports and working to dispute them. They can also provide guidance on strategies for improving your credit score, such as paying off debts and reducing your credit utilization ratio.

When choosing a credit repair business, it is important to do your research and choose a reputable company. Look for reviews and testimonials from previous clients, and make sure the company is licensed and accredited. You can also use credit score software to compare different credit repair businesses and their offerings.

conclusion

In conclusion, improving your credit score takes time and effort, but it is well worth it in the long run. By following these 6 simple steps, you can take control of your credit score and improve your financial opportunities. Remember to check your credit report regularly, dispute any errors, pay your bills on time, keep your credit card balances low, avoid opening too many new accounts, and consider working with a credit repair business if needed. By taking these steps, you can improve your credit score and achieve your financial goals.

Bonus

If you’re ready to take control of your credit score and start improving your financial opportunities, Client Dispute Manager Software is perfect for you. Start your free 30-Day Software Trial of our Client Dispute Manager software today and see the difference it can make in your credit repair journey. With our business-in-a-box credit repair software, you’ll have all the tools and automation you need to grow your own business from the ground up. And with our cloud-based platform built with the highest privacy and data security standards, you can work securely anywhere and anytime. We’re trusted by hundreds of businesses just like yours to deliver world-class support, software, and training. Don’t wait any longer, start your free trial now at https://www.clientdisputemanager.com/register. Let’s make it happen together!

Client Dispute Manager Software

[email protected]

888-959-1462

2598 E Sunrise Blvd, Suite 2104, Fort Lauderdale 33304, Florida

https://clientdisputemanagersoftware.com/

This article was originally published by IssueWire. Read the original article here.