Latest

Looking forward to watching some amazing movies this summer? Check out the list of the top 20 movies that you can easily stream on...

News

(Isstories Editorial):- Deira, Dubai Apr 4, 2024 (Issuewire.com) - Mukbang Shows Restaurant, the acclaimed destination for authentic Korean BBQ and seafood cuisine, is delighted to announce...

News on our latest developments, strategic partnerships and social impacts(Isstories Editorial):- Alderley Edge, Cheshire Apr 23, 2024 (Issuewire.com) - February and March Business Highlights

Alderley Group and...

Fashion

(Isstories Editorial):- Nashville, Tennessee Apr 19, 2024 (Issuewire.com) - Get ready to experience the epitome of luxury athleisure wear as Feline Apparel, a premier brand in...

(Isstories Editorial):- Fort Lauderdale, Florida Apr 17, 2024 (Issuewire.com) - In a ground-breaking development bridging digital assets and cannabis culture, the iconic Mutant Ape Yacht Club...

Lifestyle

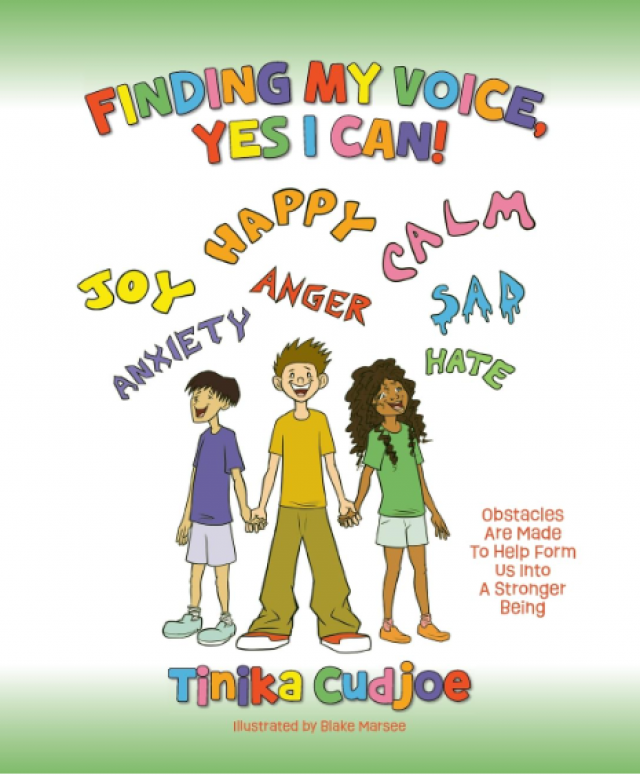

: Empowering Children and Adults to Express Themselves(Isstories Editorial):- New York City, New York Apr 23, 2024 (Issuewire.com) - In a world where emotional expression is...

Pioneering Road Safety Technology to Save Lives in Accidents(Isstories Editorial):- New Delhi, Delhi Apr 23, 2024 (Issuewire.com) - Bharat Safe QR Code introduces a groundbreaking road...

Entertainment

"Cotton Eye Joe" Sets a New YouTube Record with Three Billion Views in Just 25 Days, Cementing Its Status as a Classic Party Anthem...

Could her stance be accurate? What does that mean globally?(Isstories Editorial):- Port Antonio, Portland Apr 18, 2024 (Issuewire.com) - Christina Clement Speaks

Washington, DC- Christina "Queen" Clement,...

Aries

Mar 21-Apr 20

Today's Horoscope

Wed, April 24th 2024: ...

AriesMar 21-Apr 20

AriesMar 21-Apr 20

Taurus

Apr 21-May 21

Today's Horoscope

Wed, April 24th 2024: ...

TaurusApr 21-May 21

TaurusApr 21-May 21

Gemini

May 22-Jun 21

Today's Horoscope

Wed, April 24th 2024: ...

GeminiMay 22-Jun 21

GeminiMay 22-Jun 21

Cancer

Jun 22-Jul 22

Today's Horoscope

Wed, April 24th 2024: ...

CancerJun 22-Jul 22

CancerJun 22-Jul 22

Leo

Jul 23-Aug 23

Today's Horoscope

Wed, April 24th 2024: ...

LeoJul 23-Aug 23

LeoJul 23-Aug 23

Virgo

Aug 24-Sep 22

Today's Horoscope

Wed, April 24th 2024: ...

VirgoAug 24-Sep 22

VirgoAug 24-Sep 22

Libra

Sep 23-Oct 23

Today's Horoscope

Wed, April 24th 2024: ...

LibraSep 23-Oct 23

LibraSep 23-Oct 23

Scorpio

Oct 24-Nov 22

Today's Horoscope

Wed, April 24th 2024: ...

ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22

Sagittarius

Nov 23-Dec 21

Today's Horoscope

Wed, April 24th 2024: ...

SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21

Capricorn

Dec 22-Jan 20

Today's Horoscope

Wed, April 24th 2024: ...

CapricornDec 22-Jan 20

CapricornDec 22-Jan 20

Aquarius

Jan 21-Feb 18

Today's Horoscope

Wed, April 24th 2024: ...

AquariusJan 21-Feb 18

AquariusJan 21-Feb 18

Pisces

Feb 19-Mar 20

Today's Horoscope

Wed, April 24th 2024: ...

PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20

Aries

Mar 21-Apr 20

Today's Horoscope

Wed, April 24th 2024: ...

AriesMar 21-Apr 20

AriesMar 21-Apr 20

Taurus

Apr 21-May 21

Today's Horoscope

Wed, April 24th 2024: ...

TaurusApr 21-May 21

TaurusApr 21-May 21

Gemini

May 22-Jun 21

Today's Horoscope

Wed, April 24th 2024: ...

GeminiMay 22-Jun 21

GeminiMay 22-Jun 21

Cancer

Jun 22-Jul 22

Today's Horoscope

Wed, April 24th 2024: ...

CancerJun 22-Jul 22

CancerJun 22-Jul 22

Leo

Jul 23-Aug 23

Today's Horoscope

Wed, April 24th 2024: ...

LeoJul 23-Aug 23

LeoJul 23-Aug 23

Virgo

Aug 24-Sep 22

Today's Horoscope

Wed, April 24th 2024: ...

VirgoAug 24-Sep 22

VirgoAug 24-Sep 22

Libra

Sep 23-Oct 23

Today's Horoscope

Wed, April 24th 2024: ...

LibraSep 23-Oct 23

LibraSep 23-Oct 23

Scorpio

Oct 24-Nov 22

Today's Horoscope

Wed, April 24th 2024: ...

ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22

Sagittarius

Nov 23-Dec 21

Today's Horoscope

Wed, April 24th 2024: ...

SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21

Capricorn

Dec 22-Jan 20

Today's Horoscope

Wed, April 24th 2024: ...

CapricornDec 22-Jan 20

CapricornDec 22-Jan 20

Aquarius

Jan 21-Feb 18

Today's Horoscope

Wed, April 24th 2024: ...

AquariusJan 21-Feb 18

AquariusJan 21-Feb 18

Pisces

Feb 19-Mar 20

Today's Horoscope

Wed, April 24th 2024: ...

PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20

AriesMar 21-Apr 20

AriesMar 21-Apr 20 TaurusApr 21-May 21

TaurusApr 21-May 21 GeminiMay 22-Jun 21

GeminiMay 22-Jun 21 CancerJun 22-Jul 22

CancerJun 22-Jul 22 LeoJul 23-Aug 23

LeoJul 23-Aug 23 VirgoAug 24-Sep 22

VirgoAug 24-Sep 22 LibraSep 23-Oct 23

LibraSep 23-Oct 23 ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22 SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21 CapricornDec 22-Jan 20

CapricornDec 22-Jan 20 AquariusJan 21-Feb 18

AquariusJan 21-Feb 18 PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20 AriesMar 21-Apr 20

AriesMar 21-Apr 20 TaurusApr 21-May 21

TaurusApr 21-May 21 GeminiMay 22-Jun 21

GeminiMay 22-Jun 21 CancerJun 22-Jul 22

CancerJun 22-Jul 22 LeoJul 23-Aug 23

LeoJul 23-Aug 23 VirgoAug 24-Sep 22

VirgoAug 24-Sep 22 LibraSep 23-Oct 23

LibraSep 23-Oct 23 ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22 SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21 CapricornDec 22-Jan 20

CapricornDec 22-Jan 20 AquariusJan 21-Feb 18

AquariusJan 21-Feb 18 PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20