Latest

Looking forward to watching some amazing movies this summer? Check out the list of the top 20 movies that you can easily stream on...

News

(Isstories Editorial):- Pittsburgh, Pennsylvania Apr 18, 2024 (Issuewire.com) - Military Friendly® is proud to unveil the distinguished recipients of the 2024 Veteran Champions of the Year...

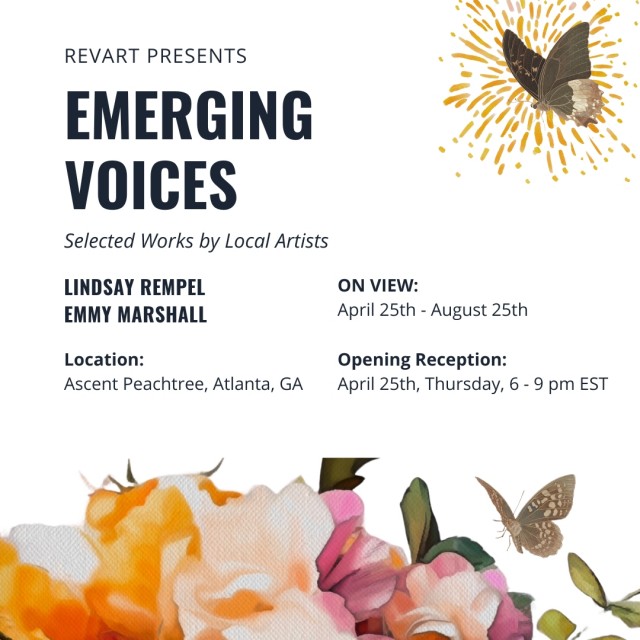

(Isstories Editorial):- Atlanta, Georgia Apr 18, 2024 (Issuewire.com) - RevArt Gallery proudly presents Emerging Voices, a duo exhibition featuring selected works by Emmy Marshall and Lindsay...

Fashion

(Isstories Editorial):- Fort Lauderdale, Florida Apr 17, 2024 (Issuewire.com) - In a ground-breaking development bridging digital assets and cannabis culture, the iconic Mutant Ape Yacht Club...

The founders of Prom Expo Unlimited kicked off prom season by hosting a unique prom event that attracted a few hundred high school students.(Isstories...

Lifestyle

(Isstories Editorial):- Celebration, Florida Apr 17, 2024 (Issuewire.com) - Aesthetics by Jennifer, a beacon of innovation in the aesthetic solutions sector in Celebration, Florida, proudly announces...

Hypnotherapist Leslie Reynolds, CH highly successful therapy program is revolutionizing the way addiction is being treated with his proprietary cutting-edge solution.(Isstories Editorial):- Dallas, Texas...

Entertainment

(Isstories Editorial):- Fort Lauderdale, Florida Apr 17, 2024 (Issuewire.com) - In a ground-breaking development bridging digital assets and cannabis culture, the iconic Mutant Ape Yacht Club...

The founders of Prom Expo Unlimited kicked off prom season by hosting a unique prom event that attracted a few hundred high school students.(Isstories...

Aries

Mar 21-Apr 20

Today's Horoscope

Fri, April 19th 2024: ...

AriesMar 21-Apr 20

AriesMar 21-Apr 20

Taurus

Apr 21-May 21

Today's Horoscope

Fri, April 19th 2024: ...

TaurusApr 21-May 21

TaurusApr 21-May 21

Gemini

May 22-Jun 21

Today's Horoscope

Fri, April 19th 2024: ...

GeminiMay 22-Jun 21

GeminiMay 22-Jun 21

Cancer

Jun 22-Jul 22

Today's Horoscope

Fri, April 19th 2024: ...

CancerJun 22-Jul 22

CancerJun 22-Jul 22

Leo

Jul 23-Aug 23

Today's Horoscope

Fri, April 19th 2024: ...

LeoJul 23-Aug 23

LeoJul 23-Aug 23

Virgo

Aug 24-Sep 22

Today's Horoscope

Fri, April 19th 2024: ...

VirgoAug 24-Sep 22

VirgoAug 24-Sep 22

Libra

Sep 23-Oct 23

Today's Horoscope

Fri, April 19th 2024: ...

LibraSep 23-Oct 23

LibraSep 23-Oct 23

Scorpio

Oct 24-Nov 22

Today's Horoscope

Fri, April 19th 2024: ...

ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22

Sagittarius

Nov 23-Dec 21

Today's Horoscope

Fri, April 19th 2024: ...

SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21

Capricorn

Dec 22-Jan 20

Today's Horoscope

Fri, April 19th 2024: ...

CapricornDec 22-Jan 20

CapricornDec 22-Jan 20

Aquarius

Jan 21-Feb 18

Today's Horoscope

Fri, April 19th 2024: ...

AquariusJan 21-Feb 18

AquariusJan 21-Feb 18

Pisces

Feb 19-Mar 20

Today's Horoscope

Fri, April 19th 2024: ...

PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20

Aries

Mar 21-Apr 20

Today's Horoscope

Fri, April 19th 2024: ...

AriesMar 21-Apr 20

AriesMar 21-Apr 20

Taurus

Apr 21-May 21

Today's Horoscope

Fri, April 19th 2024: ...

TaurusApr 21-May 21

TaurusApr 21-May 21

Gemini

May 22-Jun 21

Today's Horoscope

Fri, April 19th 2024: ...

GeminiMay 22-Jun 21

GeminiMay 22-Jun 21

Cancer

Jun 22-Jul 22

Today's Horoscope

Fri, April 19th 2024: ...

CancerJun 22-Jul 22

CancerJun 22-Jul 22

Leo

Jul 23-Aug 23

Today's Horoscope

Fri, April 19th 2024: ...

LeoJul 23-Aug 23

LeoJul 23-Aug 23

Virgo

Aug 24-Sep 22

Today's Horoscope

Fri, April 19th 2024: ...

VirgoAug 24-Sep 22

VirgoAug 24-Sep 22

Libra

Sep 23-Oct 23

Today's Horoscope

Fri, April 19th 2024: ...

LibraSep 23-Oct 23

LibraSep 23-Oct 23

Scorpio

Oct 24-Nov 22

Today's Horoscope

Fri, April 19th 2024: ...

ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22

Sagittarius

Nov 23-Dec 21

Today's Horoscope

Fri, April 19th 2024: ...

SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21

Capricorn

Dec 22-Jan 20

Today's Horoscope

Fri, April 19th 2024: ...

CapricornDec 22-Jan 20

CapricornDec 22-Jan 20

Aquarius

Jan 21-Feb 18

Today's Horoscope

Fri, April 19th 2024: ...

AquariusJan 21-Feb 18

AquariusJan 21-Feb 18

Pisces

Feb 19-Mar 20

Today's Horoscope

Fri, April 19th 2024: ...

PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20

AriesMar 21-Apr 20

AriesMar 21-Apr 20 TaurusApr 21-May 21

TaurusApr 21-May 21 GeminiMay 22-Jun 21

GeminiMay 22-Jun 21 CancerJun 22-Jul 22

CancerJun 22-Jul 22 LeoJul 23-Aug 23

LeoJul 23-Aug 23 VirgoAug 24-Sep 22

VirgoAug 24-Sep 22 LibraSep 23-Oct 23

LibraSep 23-Oct 23 ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22 SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21 CapricornDec 22-Jan 20

CapricornDec 22-Jan 20 AquariusJan 21-Feb 18

AquariusJan 21-Feb 18 PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20 AriesMar 21-Apr 20

AriesMar 21-Apr 20 TaurusApr 21-May 21

TaurusApr 21-May 21 GeminiMay 22-Jun 21

GeminiMay 22-Jun 21 CancerJun 22-Jul 22

CancerJun 22-Jul 22 LeoJul 23-Aug 23

LeoJul 23-Aug 23 VirgoAug 24-Sep 22

VirgoAug 24-Sep 22 LibraSep 23-Oct 23

LibraSep 23-Oct 23 ScorpioOct 24-Nov 22

ScorpioOct 24-Nov 22 SagittariusNov 23-Dec 21

SagittariusNov 23-Dec 21 CapricornDec 22-Jan 20

CapricornDec 22-Jan 20 AquariusJan 21-Feb 18

AquariusJan 21-Feb 18 PiscesFeb 19-Mar 20

PiscesFeb 19-Mar 20